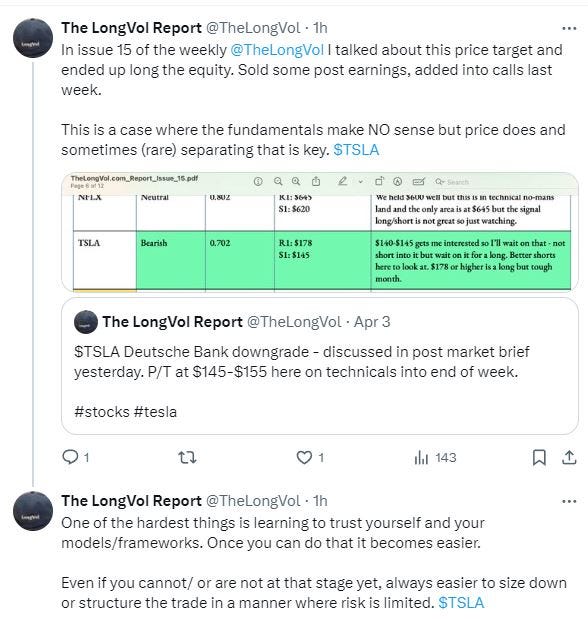

Tesla was up +15% or nearly $25 today which is just incredible and a welcomed gift from Mr. Market. For those who follow this report and the nightly recaps I began discussing this back at the start of the month in Issue 15.

This was also a point of highlight in this weeks Report - Issue 18

Hard to argue the fundamentals not being there on the stock but sometimes you have to follow your model/system and tune out the rest - this was one of those cases. People will argue with it, debate on X, whatever…I had the shot, there was no danger so I took it. (Nice)

I bought the equity outright a few weeks before earnings, then got long some $185 strike calls post earnings last week. I’m not a big fan of trading directional calls/puts on this name that short-term because the stock in recent years has become a retail options trading hotel where market orders hit the tape left and right and volumes get over +120K almost daily on certain expirations.

That makes it harder to trade with an edge and there are usually other markets/stocks to trade in that are less crowded. However, this stock just has too much buyside sentiment by Tesla fans and the short interest aided that so the long directional trade made sense and it worked, this time anyway.

Moving on….

BABA - this has my attention again. Not that it lost it, I’ve been talking about for a while, to catch you up, here were my thoughts from the WYMTW article a month ago.

I took a position again in the name as of today and shared it with DeltaOne members.

Hard to argue with the valuation as noted in that post (if you read it) but I wanted some other factors to come into play and they did hence the new position there.

There’s a lot of items on play this week across asset-classes and situations. With the USD/JPY move, to SMCI 0.00%↑ and AMZN 0.00%↑ earnings tomorrow and FOMC into Wednesday so I want to start by getting into the recap from the market today on S&P500…

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.