We absolutely nailed this move today on the market after a tame PPI number and a delayed market reaction this morning on S&P500 and the rest of the names. Most of it was bear-traps on the lows only to squeeze and $5180 was a key spot. This is part of what was said in premium last night for subscribers.

Again, no forecasts for me other than inflation longs (macro view) but short-term $5260-$5280 is a sell zone and below $5180 that $5100-$5120 spot is in play. I don’t think we come back from that if we get there meaning we may absorb but ultimately sell-off.

We got near $5260 today so this was a good intraday move across S&P and related high beta.

The move today was caught well from a few folks in DeltaOne.

+$3,500 on Index Flow strat from one of the members.

A nice day for NVDA flow for some members as well

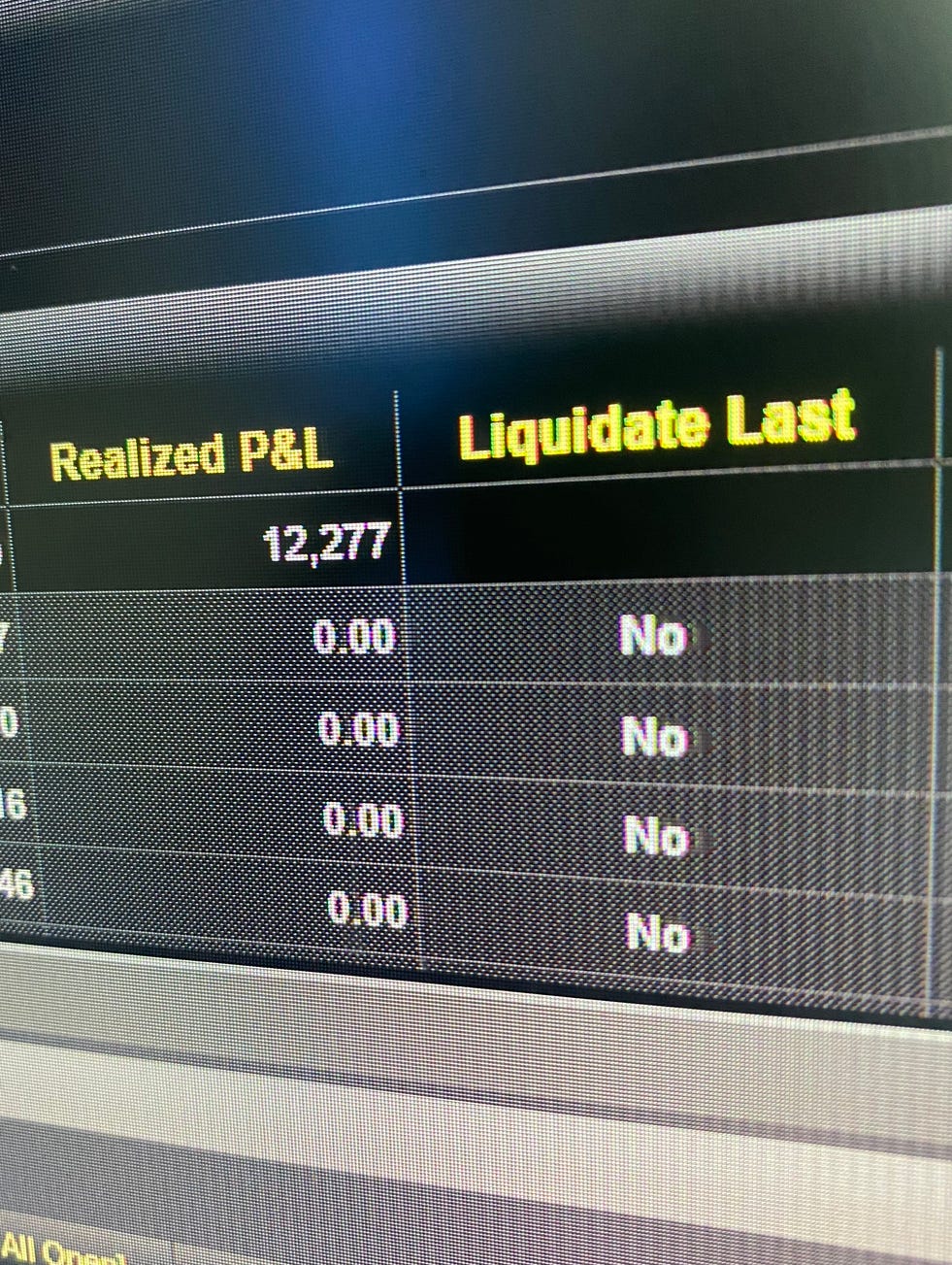

Then one who had multiple longs in play for $12K

Overall, this was a quality day after a week of data which everyone was uncertain about. Last night there were two ideas shared for today for members.

I am going to start with two ideas I discussed Sunday and again last night.

GOOGL - Above +$157 tomorrow triggers a long into $161-$164 so for the short-term trading playbook there is something to pay attention too.

META - Above +$525 that $$540-$550 target may print. If we fail there on this PPI data and market at large tomorrow look to be short. All of this is at key inflection points so the move(s) into Friday might end up being outsized so just keep that thought in the back of your mind.

The LongVol Report gets put out each Sunday - there are 3 sections:

Momentum Trading (usually 30 day or less directional options)

Swing Trading - Themes/fundamentals (usually equity or DITM calls)

Special Situations/Event-Driven - Equity driven investing

So let me breakdown how to use the report using the Momentum Monitor and the intended framework as to which one will get the best results out of it.

(This is important because some of you take a hammer and try to use it as a screwdriver).

The Momentum Monitor

High beta momentum equities

1-20 day trading holds

1-30 day directional options OR long/short equity

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.