Sideways markets today even with Powell speaking and sellers had a few chances to take us below $5090 area but they failed so up to the bulls to see if they can stage a rally. That $5090 spot is a big deal - we didn’t find bids near that all day and sellers fail to come in and make it work but the higher time frame damage has already been done. I still don’t like being net long exposure here on many names tied to the market and that $5000-$5020 area is on my radar.

Even with a bounce into $5140-$5150 concerns are there to be bearish on the overall flow esp. with Israel/Iran risk which is a big deal - despite what your local Twitter/X guru wants to come off as it’s not.

COIN - this was a good short today off the opening drive and there was a note on the Sunday report about it.

That was an opening drive short-setup. Discussed in FOPT.

This was the rest of the market today.

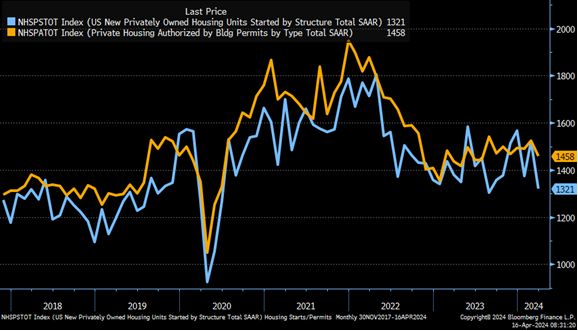

Housing starts missed and came in -14.7% lower and home builders are down on that. I’ve talked about this at length as big shorts coming and we’re close still. (LongVol Twitter)

The Premium Recap is inside.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.