Get 50% off for 12 months through the end of Summer 2024.

Wednesday Reads

If you missed the weekly LongVol Pod/Show - watch it here.

Trading Notes:

This move today was what was discussed in last night’s market outlook video and then again in the Sunday outlook.

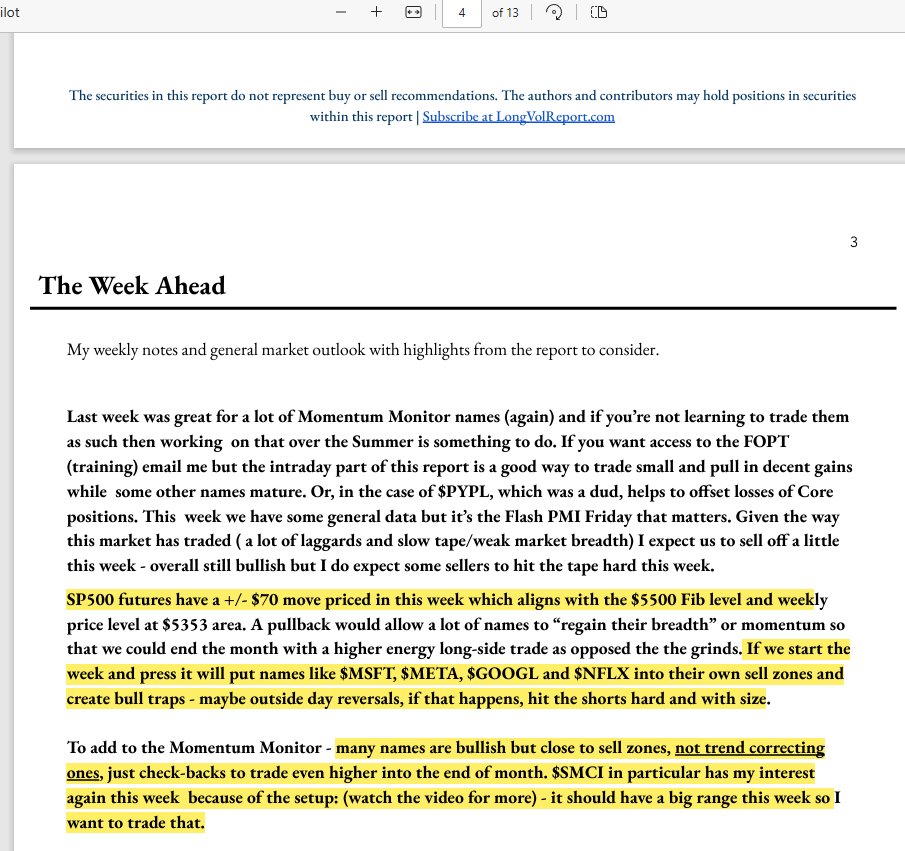

Coming into this week many of the SPX/Nasdaq names had setups but were showing signs of exhaustion or, in the framework used here, approaching sell zones. That’s key for market analysis - for trade plan development, execution and overall planning - last night the video and trading notes reiterated traps (outside day reversals) and SMCI 0.00%↑ was a target for what we saw today in that name - which gapped up and then reversed nearly $105 points off the high-of-day.

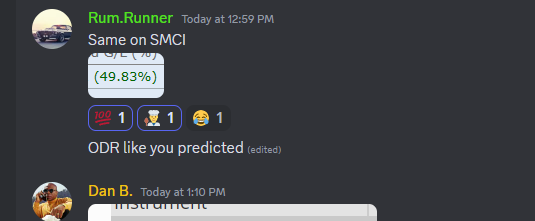

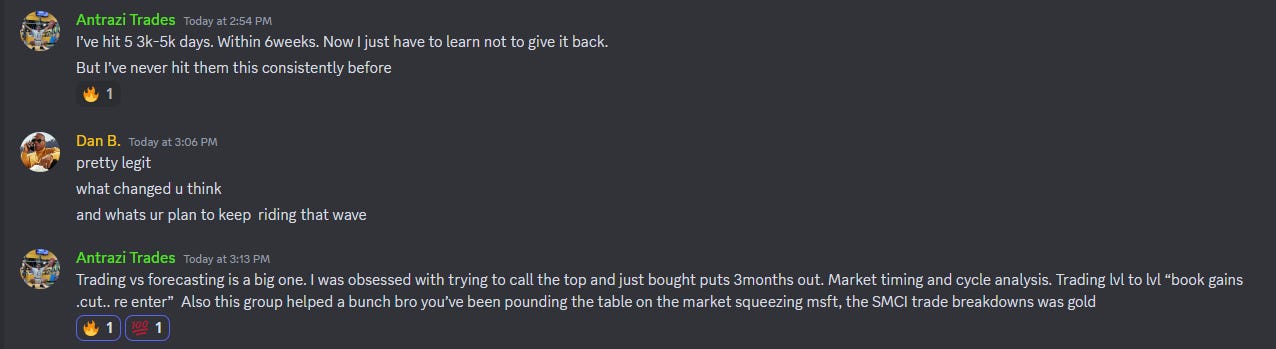

Some notes/commentary from the DeltaOne room today.

Worth nothing on the second photo.

This part was left intentionally free to non-readers today - if you’re reading, then maybe that gives you insights to how to compartmentalize your portfolio. Not everything is “day trading” and not everything is you pretending to be Warren Buffet looking for companies with “moats” because you once read a quote and failed to think it through; it can be both.

Most of what is on this site is momentum/high beta equities. Meaning trading SPX/SPY/QQQ/WTI Crude and a rotating list of 10-20 stocks that I have been trading since 2013.

The Core Holds, turnarounds swing concepts are withing the full LongVol Report. One of those I talked about a month ago was TSM 0.00%↑ - that stock is up +$40 from when I discussed. Video/Podcast 21 is out Saturday.

So, what we got today was what we were after Sunday and with OPEX tomorrow I think most of the short-term flow is done but there are a few things to cover tonight.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.