Today was my last day in this securities class that I’ve had to take and I could not be happier. I have to say, for some of you new to this world, I can see why being new to it is confusing having witnessed it first hand this week with others who were in this online class and new to this world.

This is what it reminded me of, sadly.

Moving on….

This week overall has been really good for trading again with this risk-off you’re seeing and I just keep pointing back to that CPI print last week. It’s risk-off for a while even though we’ll get bounces here and there and I shorted more Russell 2000 today to bring that up to a max size short.

The narrative is REALLY simple. The market priced in rate cuts last fall and you saw that Russell 2000 come alive only to die out as we realized rate cuts are likely not coming.

We’re at the stage now, especially with that Fed comment today, where the selling on Russell 2000 should really start to begin.

I talked about IWM being a short on my radar two weeks ago and I think we’ve got more to go into next week on this short.

Moving on…

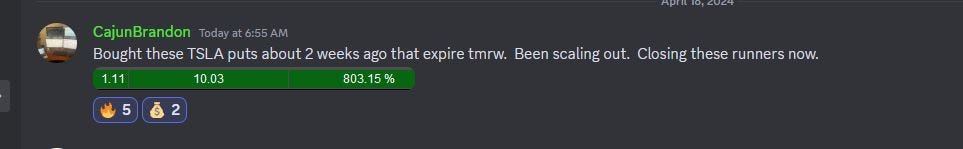

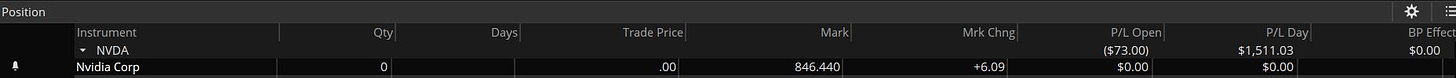

Some shorts panned out in the community today as well, one on Tesla, the others on Nvidia which were short-term trades into end of week.

Tomorrow is monthly options expiration so I expect a few pins to happen on some names and that the S&P500 trade within a tighter range. OPEX is a big deal and the “book” doesn’t talk about that - will cover in premium video tonight.

Oil/Gas - Most of these names are down on the month and that includes WTI crude this week which is down from $86 (nasty move). I said it in the Monday recap but let me say it here again: the most generic trades you can make are the ones based “around news”.

There was a trade this week (Monday) on WAY OTM Crude calls (Bloomberg)

Seemed a bit silly of a trade but just another reason that following call/put sweeps remains an amateur/retail way of investing.

Remember; by the time you hear about it, it’s too late.

Just like at the start of this month when we were exiting oil/gas longs and others (CNBC/Your gurus on Substacks pretending to be Professionals) starting talking about XLE 0.00%↑ -

Tomorrow is OPEX….let’s get into a few things to recap this week and talk about some potential OPEX plays to run based around some levels on a few names.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.