As we head into the bottom of the 9th the score is all squared up with Jerome Powell and Co. up to the plate. That’s what this feels like into tomorrow and even with that little risk-off move near the open today, the call is still open as to if this is safe to be net long risk.

One thing is certain: people are going to get caught offside.

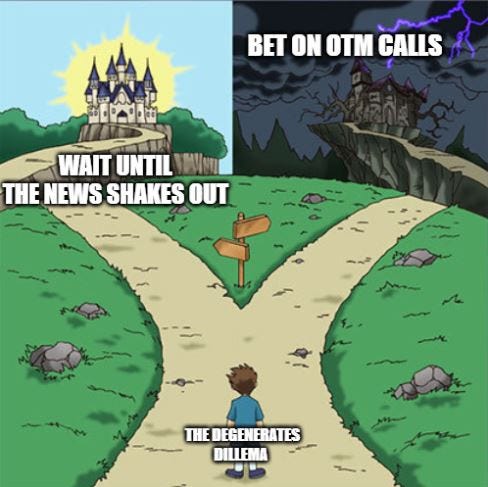

I don’t like binary outcome events like this (which happened to me on SAVE 0.00%↑ earlier this year) even though your local guru does. If you make the call and get it right you get to do the happy dance, sell at the open, and praise the guru. If you get it wrong it’s “bad guru” Move to a new one and repeat this process until your wife tells you no more trading and then makes you head to the local Charles Schwab office where you’re forced into a 60/40 portfolio all while she’s starting to listen to Dave Ramsey podcasts.

I’m not married, for the record, but that’s how I picture most of it going down.

What I am saying is I am waiting on this event tomorrow to shake out then press it because there will be vol it’s just better, in my view, to wait until the shakeout post news. If the number is cooked, then it sucks in the rally and we get the risk off in metals, utilities, and other names that I am waiting on and that’s all a plus.

Because, regardless, inflation is raging - even with cooked data.

And as Wayne Gretzky said: “You skate to where the puck will be, not where it’s at”.

PS. The webinar at 7 pm EST was pre-recorded. You can watch it here at 7pm EST.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.