Well…your local guru this morning tried to come of as smug with the “why was everyone so worried over the weekend” and the “own stocks you like Tweets” - you know, the generic stuff that generic people who don’t actual run risk say.

I’ve been at this since 2006 and I’ve seen things across deals and markets you could never imagine and I’ve seen people get humbled left and right, especially, the ones who try to come off as if they are “calm cool and collected” online. In reality, those are the people who are the exact opposite and you should run from.

None of these charts look good from S&P500 to Nasdaq and especially the Russell 2000 which I am short (as of today. The risk out of the Middle East is an issue and the fact that you saw bonds do what they did today is just ridiculous in itself.

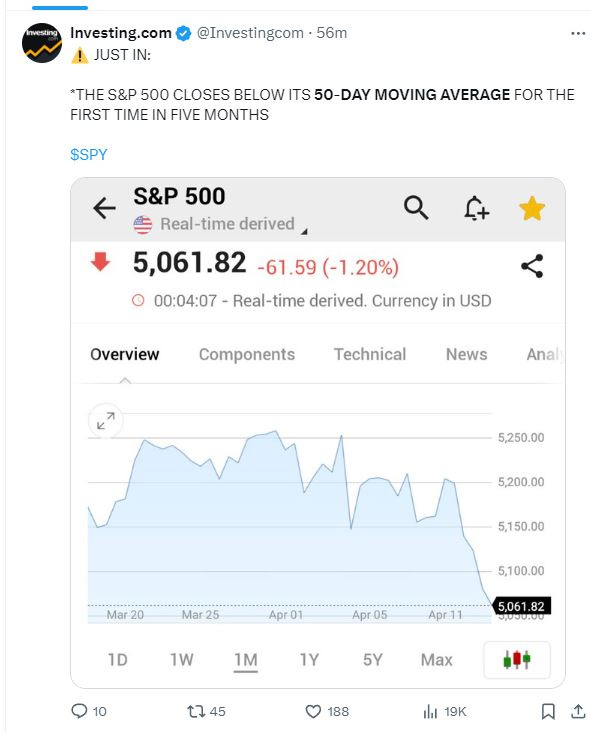

I know many of your gurus love to talk about moving averages: I don’t. They’re lagging and by the time a stock closes above/below one it’s already too late. And it’s usually people that don’t trade that love to talk about them because they’ve never bothered to come to a conclusion on their own for how things work.

For example, the 50 day moving average closed below the blah blah blah…that has 45 retweets and 19K views. Does it matter? Nope.

You may or may not laugh at that but I’m serious.

By the time the average trader/investor sees this it’s too late. By the time advisors and amateurs talk about this “did ya see the 50 day move below today” tonight, it’s too late. Markets are always pricing in risk long and short and you need to be ahead of that risk because by the time most act, it’s too late.

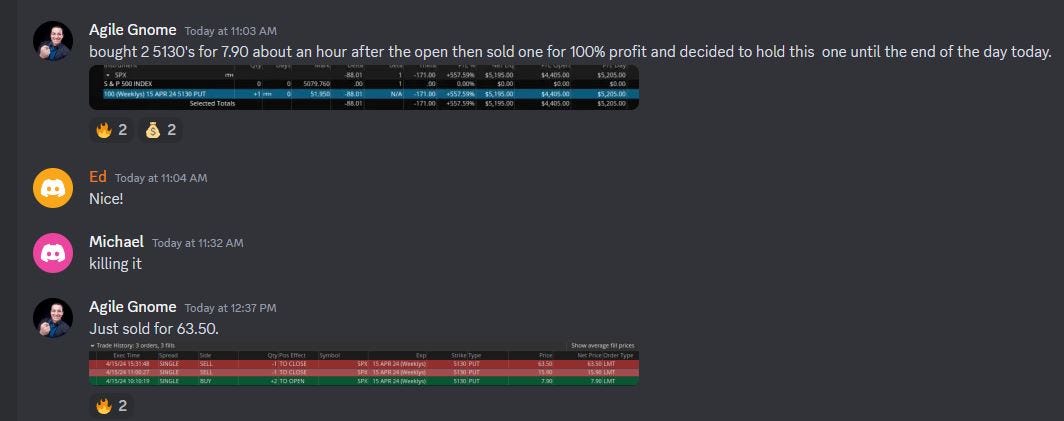

I was short this move early this morning and elected for futures and others in DeltaOne were as well, some with SPX puts.

That’s a good hold on that second contract but for him it makes sense cause he’s been with me since 2017 so he gets how it all works.

Some of you are new and still learning but eventually you’ll come to the light and realize that there is a method to this madness but only when you’re ready to receive a new perspective.

Normally, I don’t trade futures anymore but I will when there is a larger move setting up: larger defined as +40 points or more and when those happen it’s max risk and today was one of those situations.

Anyway, you get the idea. Premium recap is inside!

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.