Standard bounce today on the S&P500 and most names which was the call from the report last night.

Here are the notes from S&P500 last night:

$5040-$5050 tomorrow are zone one. Above that we get into $5090-$5105 and that spot should be sold but be sure to see that sellers commit to that. If we get there, see how we sell and if they ramp it up. $4990-$5000 is support. Below that we drop down pretty fast into $4930-$4920 then below that it’s $4850s.

I would look to be long but smaller size then add if we break $5050s but we really need to see buyers step it up. If the market expects the data to come in below expectations Tuesday you might see that but overall this market is bearish given the data the last few weeks and Fed comments so keep that in mind.

$5076s printed and that selling was decent to end (you can insert a made up reason as to why here). PMI is 15 minutes past the open tomorrow and there are two scenarios:

Scenario 1: Below $5020s this opens up the short again into $4990-$5000 which has to hold or those zones above are in play. The problem with this is if we get there we likely take that out and we begin some nasty selling lower so if you’re a bull right now you don’t want to see this.

Scenario 2: Above +$5070 we can go and test $5100-$5105s and from there make the assessment for what is next on the S&P.

Moving On….

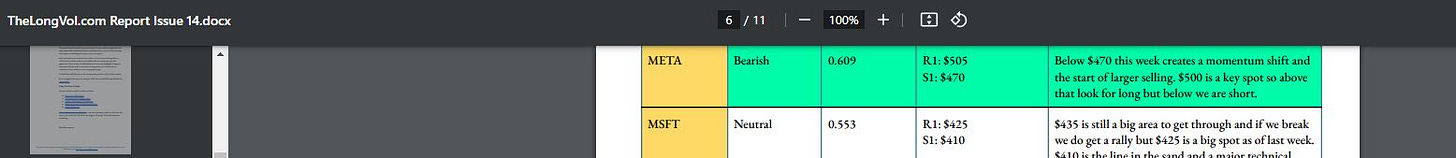

META - I started talking about this in Issue 14 (start of April) and I have been bearish it since then. The stock has earnings this week so we’ll see what they say. I think it’s silly to be long or short the name into it and regardless of what they say the tech trade is over-crowded.

One thing I think most forget to take into account is that the trade into tech/Mag 7 was THE trade the last 3-4 months in fact, if we’re being honest here, it’s the only trade for a majority of Pod shop bros and financial advisors.

There’s about a +$42 move price in on it this week and I know one thing: if we gap up to $520-$540 at all post-earnings I am shorting that name.

It’s all been a short: I talked about this since the start of April.

The CPI print and Fed comments confirmed all of that for you so until the data changes every pullback is a chance to short. (On the main momentum names - on some other non momentum stuff there are plenty of buys)

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.