I’ve been stuck in class for this securities exam but was able to trade a bit today and thankfully able to short S&P500 with $SPX puts as well as get short some other names I talked about.

NVDA 0.00%↑ opening drive short was really the move today but just didn’t have the focus to do that and do this online class so I had to sit back.

This was all a continuation of Monday’s selling again today and I talked about this Monday, yesterday and at the start of the month in issue 14 of The LongVol Report.

I’d be lying to you if I said this was not great to see esp. after all the smug comments Sunday night about “the markets not selling off” - I see your gurus on X posting and they lead many of you to slaughter.

However, if you paid attention to the reports that me and the crew here put out you’ve been on the right side of the trade.

These were part of the notes from that issue (March 31) and I’ve been talking about it since then that risk-off was on the table and here we are.

That zone we tested last few weeks was a good start so if we re-test that and fail that’s really all I need to see. Given we have a lot of data this week that may be the catalyst here to drive price lower. A lack of momentum (if we rally at all) should be noted and caution to selling pressures this week. Below $18,100 area is a spot to watch and if we get close starting a 30/60 day index short might be a trade to research.

We’re well past that spot on Nasdaq and $17,200-$17,350 area are next to see if buyers come in a bit and absorb this risk off.

S&P - we had offers below $5090 today which was the spot to break and we absorbed near the targets discussed last night in premium and publicly. The retest at $5090/$5100 was sold again and it’s important to remember that this is likely due to that CPI print last week, bonds and general risk off.

For those new here, none of that matters, what matters is if you make money from it and that was the key today.

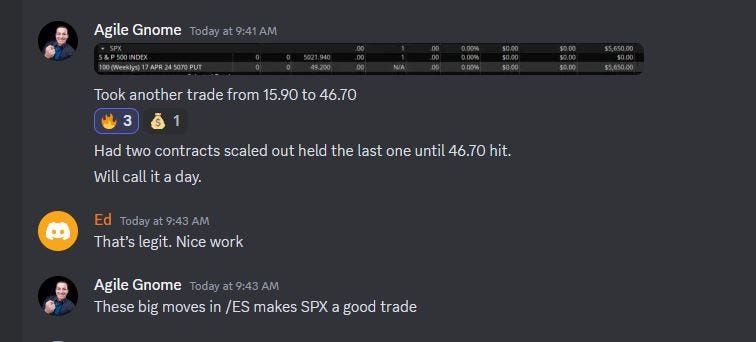

A -$40 point move was executed with SPX puts and some subscribers cleaned up (+$5,000 plus for a few folks).

BABA - The stock made another low today and remains a value trap. There are things to remember in markets regardless of what strategy or view you run. Something is only worth what someone is willing to pay you for it. It’s “cheap” by all accounts but if there’s no willing buyers then it goes lower.

That simple. Some of your advisors and gurus who are new to the game and are still learning to thin for themselves will come to the conclusion (eventually) that having an idea is only as good as the execution.

This remains a pass for me until we get to $55-$62s.

The Premium Recap video and trading notes are inside for subscribers.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.