Are we ready for a pullback?

The housing market, nationwide, has been on fire.

Everyone who has watched at least 10 hours of a Grant Cardone YouTube video session is now a real estate investor. Real estate agents are driving McLarens (seriously) and bids are going for over ask. You have bozos calling for $1,000 on GME and DOGE coin surpassing major companies in market cap.

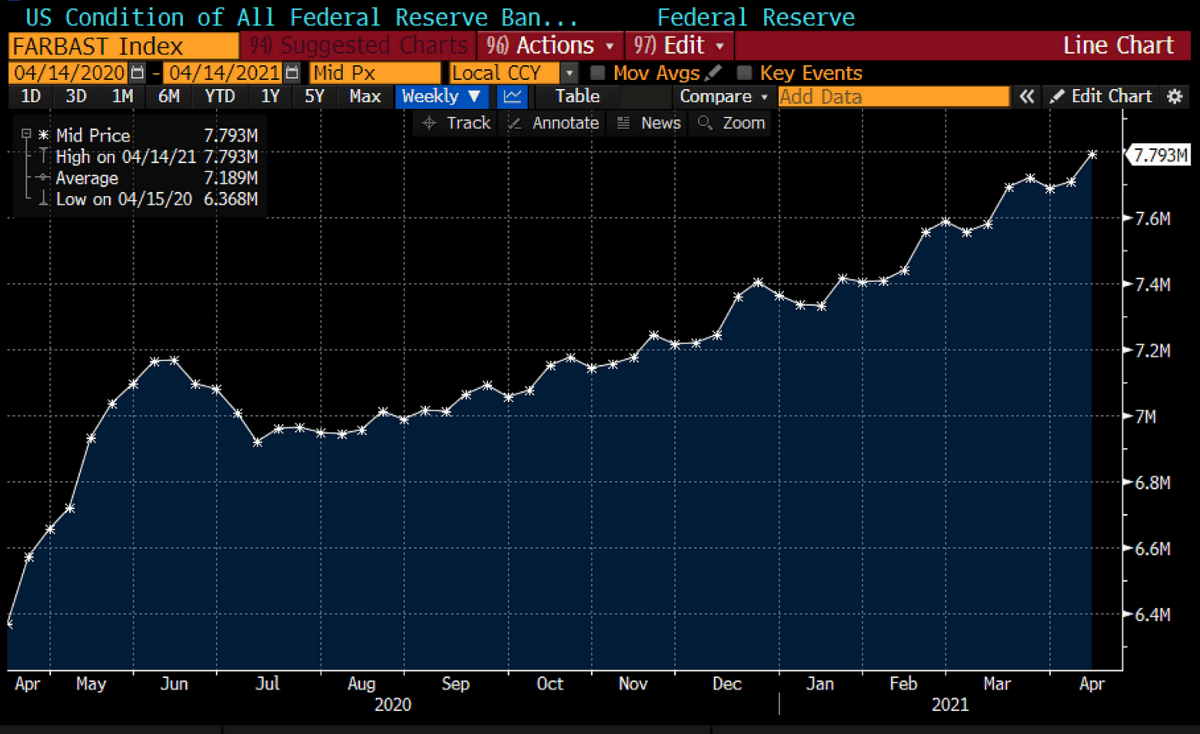

The Fed balance sheet as of last week is nearing $8 trillion and housing markets, especially in Phoenix, are on fire. But when does it end?

Admittedly, I missed the real-estate boom the last 6 years mainly because I was busy working on building a few companies and getting back into more private-equity deals with hard, cash-flow producing assets. That, and I trade the markets like rain-man on a daily basis so my attention is 80% there regardless of where we are in the world. This was true for the 08/09 crisis: I was not in real estate but I was trading the markets.

Am I upset to miss this housing boom? Yea, of course. Do I think it blows up like 08/09? I am nowhere near smart enough to guess or understand that, however, from a trader’s perspective, I do think we are in for a nice reset and slow down in real-estate (hard asset) and real estate-related stocks.

Where I think I can participate in this is through equity markets within equity-related companies that have ties to real estate. After all, there are no employees, tenants or loans to service with this model so I can participate in this boom AND bust, just in a different manner.

Housing Starts

Last week housing starts released and they hit 2006 numbers which makes sense given what has been going on.

It’s pretty crazy to see, even crazier, to see where that type of income is coming from to afford some of the items I see. At first glance, the stimulus over the last 10 or so months is clearly a large factor to all of this including the obvious, low-interest rates.

I remember the 08/09 era, I was just out of college, and in Phoenix, everyone seemed to be crushing it. In 2007 a great friend and I almost purchased a house about a mile away from Arizona State University. They wanted $650,000. Insane. We decided against it even though this real estate agent pushed for it (not a fan of real estate agents). When the crisis it, it nearly dropped in half.

Today that house is about 20% over what it was then, so still crazy, but nothing like 08/09. My sentiment is that of everyone right now: When will it pull back? You have real estate agents constantly posting you need less than 10% to buy a house and all these regurgitated visual data points to increase their pocketbooks. In fact, if any of you can find a real estate agent to ever say “hey this is not a good deal” you should thank them and buy them dinner.

The question is does it pull back? I am not at all sure. For me, I could care less, I would rather own land assets like this - The cost for the land is usually much less than housing and the maintenance is far less. Again, not knocking real estate, there are friends of mine who have cleared north of $5mm the past few years with it.

However, I am cautious with all of this because, like all assets, there has to be room for a said asset to grow. Further, this nonsense that is perpetuated that your own is your retirement is a joke. This is not 1950 anymore and if you are relying on that, in my opinion, you’re playing a dangerous game.

Now that being said, I just purchased a home on an island, away from this mess, but at a price point where I can see the upside, in addition to some tax advantages. What I cannot see here, at least in local markets, is the upside and the markets (equity) are showing just that this week.

Divergence in Housing Stocks

The housing starts were clearly amazing numbers and Canada posted Monday with numbers not seen since 1977. This has been talking between a group of friends of mine the past few months. All of them, much older, some money managers some head of research at firms like Gavekal, and other seasoned analysts and PM’s, all of which, who I am lucky to be around. In fact, I usually never really chime in much to the email chains and really just read and occasionally ask to learn.

What we discussed as of recent were lumber markets, which are on a tear, as well as select homebuilder stocks. The data that was released last week was largely positive, yet, we have begun to sell off today on many home builders.

This is usually a bad sign of what is to come.

The question is, how do you trade this? There are a few ways and the most direct way is through publicly listed housing stocks.

I took time to look at the holdings inside the NAIL 3X Homebuilders ETF today.

I also took time to look at real estate brokerage firms like EXPI and RDFN.

As of the time of this letter, my book has small short positions in DHI and LEN. In fact, DR Horton has earnings this week so I am very curious about how they guide. If you were to look at the building they have going on and the projects, at least the ones I see locally, it looks great.

The thing is, the divergence after we’ve had those great housing starts concerns me.

Now clearly Uncle Jerome has stated that they are on a path where they are not going to raise but, like Hugh Hendry, I am not sure I believe them.

The real thing that I am after as of now is how to best structure the short trades. Usually, there are a few ways:

Short equity

Sell calls

Buy puts

But what I really mean is, what other companies have the better chance of selling off that are non-home builders? So, that is where my research leads me next.

Be sure to subscribe below.

You can follow me on Twitter here.

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.

DIY Investor with more than $50,000? Consider joining DeltaOne.

Too Busy to Research? Check Out The TLV Report.

Thank you for reading. LongVol grows through word of mouth. Please consider sharing this post with someone who might appreciate it.