My Investment Framework.

The Top Down Approach

This is a quick look into the investment framework that I apply. The model is best described as Top Down, long-short trading across asset classes.

The research, insights and overall investment view is predicated around a few items:

Alpha is generated cross-asset classes long and short

Macro, Fundamentals & Technicals provide a clear and repeatable framework

Assymetryic idea generation is a key component

Trade structure is just as important as the trade idea/thesis

All of those combined allow for long/short trade idea generation. Whether that is active through intraday to 30 day holds or a 3-9 month horizon it is a ‘go-anywhere’ approach to generating alpha.

The Four Strategy Sets I Deploy

I really just run 4 core strategies, and within them, sub-strategies.

Momentum trading on high beta equities

Swing/Inflection trading on stocks/etfs

Value (rare but I still actively look for it)

Special-situations/event-driven (short-selling/short squeezes, shit-cos)

My approach is that it doesn’t matter what asset class or what market environment it is that there is always a way to generate P&L.

I’m not a day trader but rather an analyst. I care about one thing: making the number on the screen bigger while producing risk-adjusted returns meaning I believe in managing a portfolio with multiple strategies.

I’ve studied hundreds of investment approaches in my career and I don’t think one is necessarily better than the other (Value, macro, debt, short-selling etc) - it’s all the same to me because the framework allows for it.

This is the same framework that was instilled to me in 2009 as a prop trader and to be more clear, that training was almost identical to that of many of the Market Wizards like:

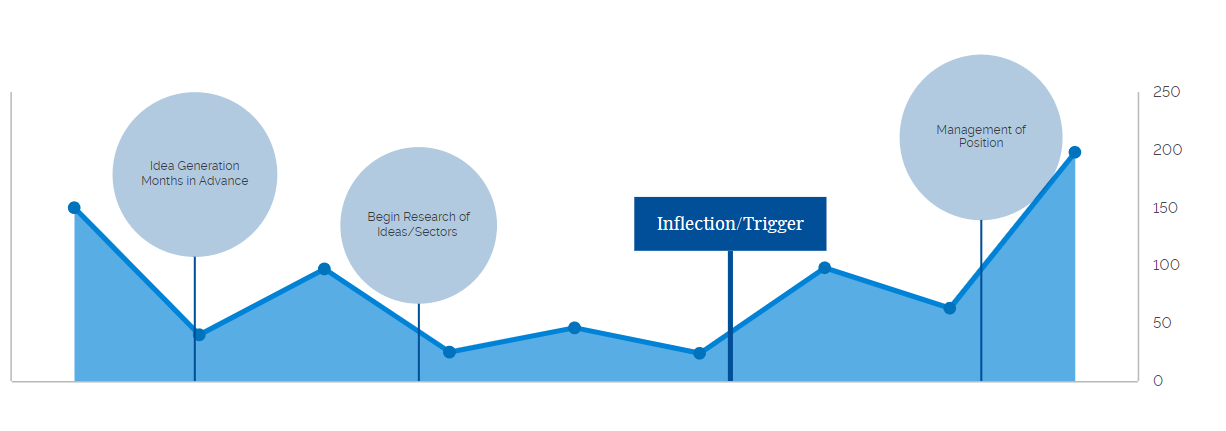

Using a 4-step approach gives me a repeatable framework and I’ll start by explaining this step-by-step.

This is what it looks like visually.

The final step is management but it’s obviously the 4-steps before that to get there that matter most.

1. Market Sentiment

It always starts with market sentiment whether that is defined as look at the overall market at large or looking at a particular stock.

Let me give you two real examples from this last Q2 with the strategies I run.

Momentum Equities -

I will look to understand what the major indices are doing from multiple perspectives. Are they bullish, bearish, sideways? Is there a large move set to happen - a breakout of range? A breakdown of range?

When I can gauge that then I can understand the sentiment.

Event-Driven/Shorting -

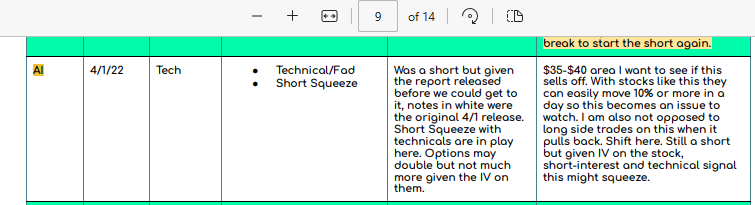

Just two weeks ago in the report I discussed shorting AI stock because I saw a potential 30% move (more on this on mental model change below).

On individual equities I want to read the sentiment of that stock. In this case, what was going on in that sector? Was it over-crowded? Were shorts trying to squeeze it? Was there a pending news catalyst?

Once the narrative is identified and understood then you have a consensus view.

As a trader I make my money on price movements and for me, personally, I want BIG price movements to make it worth my time (though I’ve adjusted some things in my mental model a bit).

You have to understand the other players at the table.

2. Research

Then comes the research phase.

Research varies on the strategy, and I’ll explain. With the Momentum Equities strategy, I deploy that research is pretty simple.

Here are examples of that:

What news is coming out?

Were there upgrades downgrades?

Is that particular stock being traded too much by Reddit or crowded by hedge funds?

What is FCF and other balance sheet items saying?

Again, just some of the questions I ask - not all, but some…it’s just a process of deducing things as a detective would trying to solve a case.

When it comes to short-selling, like on Carvana or PTON in Q1 - that research takes more time.

That means going into the balance sheet and more to understand things so I have a fundamental backdrop of what SHOULD happen.

With Inflection/Swing Ideas the research really starts with a macro approach. If I can spot something happening from a macro or business cycle approach, then I just break down what stocks (or ETFs) will best benefit from that.

Sometimes it’s just easier to use an ETF in that sector undergoing an inflection to express the idea - sometimes it’s an actual stock.

Once that part is done the technical/market-timing overlay is applied.

3. Technical/Market-Timing

This is the most important part of all of this for me. I believe in a ‘go anywhere’ approach to find returns.

I always say “alpha is not static” meaning that the hot-money does not get stuck in one sector forever: it’s constantly flowing, in some (like Momentum Equities) it never really leaves - due to indexing and institutional flow.

But in others, it moves.

My technical/market-timing framework is the key. Despite what any of the following two steps in:

Sentiment reads

Research

If the technical/market timing don’t make sense to me then that idea/situation is avoided.

Example.

In the Swing/Inflection monitor I had been tracking EXPE for an entry since mid-January.

It passed sentiment and research, so it went on to step 3.

But I wanted to see an entry near $95-$100 first to get long and just last month that ideally finally triggered which leads to step 4.

To give a more clear example - Carvana short - I’ve said that countless times and wrote about that here.

When they meet the triggers then it’s time for the actual execution.

4. Execution of The Trade/Trade Structure

This part, if I did all my work in the prior steps becomes the easy part.

What I’ve found is that doing the work ahead of time, the right way, with a repeatable process, leads to predictable results.

So, when it comes time to get into an idea - be it Momentum, Inflection/Swing/Value or Event-Driven that idea has been developed.

The risk on that idea has also been decided ahead of time.

I suggest using alerts to remind you when a technical breach/trigger occurs so you don’t miss the idea.

But as a fail-safe, you can just check the charts (or the report like I do) each week.

This is what it looks like up until this point - you can ignore the months in advance part, that is from my deck and I just did not feel like changing it. Obviously, some of this is a week in advance.

5. Trade Management

Managing the trade is the last and final part of all of this.

Do you add, reduce or just flat out exit?

This varies on each idea. If it’s a long-term hold then I really just let it do what it needs to do. If it is short-term momentum maybe 1-5 days and then with medium term ideas 1-6 months at a time.

There is not a clear answer for this and to be clear trying to explain it is not my goal here as this is my process that I use.

Recap of Framework

This model/framework is what makes it possible to run a multi-strategy portfolio that allows me to benefit from various asset classes with one goal: generating returns.

It allows me to hunt for the best situations/setups because I am just taking my lens from one strategy to the next and seeing what the most optimal play is.

Again, this works for me, it doesn’t have to work for you but this should give some perspective.

Membership Options

Choose from two memberships.

The LongVol PDF Report includes the digital membership.

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.