Earnings season all week so expecting more of the quick flow and balance days so I’ve been trading off the open and waiting the rest out.

I had a chance to finally check out my friend’s restaurant in Phoenix called Publico and I can’t say I was mad about it.

There was also a good read here today (it’s paid) but if you’re after some macro insights it’s worth the look.

People today seem to say the bear market is over. Noise.

There is no bear/bull market - just a market to trade up or down but context and sentiment certainly matter.

S&P500: Scenario 2: Above +$5070 we can go and test $5100-$5105s and from there make the assessment for what is next on the S&P.

Quote from members paid: Flash PMI is tomorrow at 9:45 am we need to see what the market wants on this but the move is listed above for S&P. Ideally, we get a big sell off below $5020 so this all flushes out. If we don’t and rally to $5100 we’ll get a shot at a flush from higher again on Wednesday and Thursday news so regardless don’t get caught long aside from day-trades.

No flush or trap today just straight up then balanced at $5100-$5108.

Earnings are this week (TSLA today) so most of this should wait on all of that which is likely the pause mid-day.

$5130-$5140 is the next spot to watch as of now and $5090 is back to being support.

A few ideas for opening trades tomorrow in premium and a quick note on Googl earnings later this week.

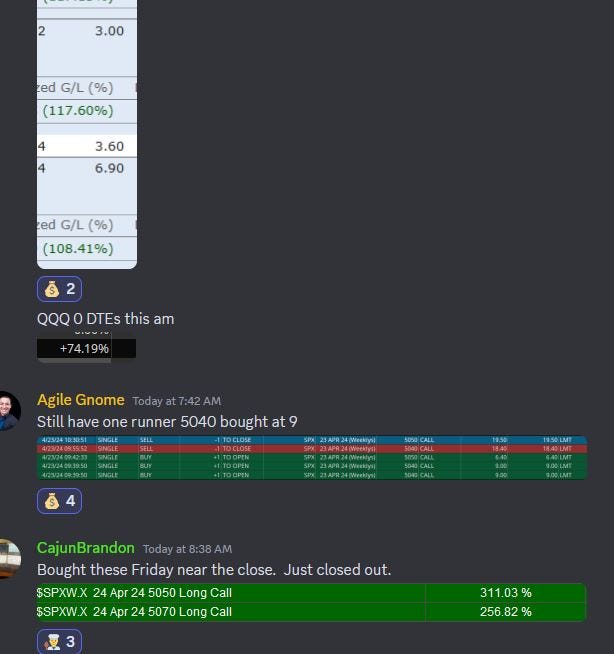

Since we’re in the Voyeur era and everyone loves to brag - a few of the folks in DeltaOne today had some nice closes on SPX and others.

So easy, a caveman can do it. - That’s my new 2024 motto.

Follow me for more on IG. It’s my public one.

P.S. Will be in Vegas next week for a conference if you are going or are there for it ping me on BB chat or email.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.