Episode 1, January 1, 2023

Join DeltaOne Here.

Get The Full Report & Community Access Here.

The securities mentioned in this report are not buy or sell recommendations. We are not responsible for decisions made based off of this report. The writers of this report may or may not have positions listed in this report.

Data sources: Bloomberg LP, TD Ameritrade Inc, Company Filings, LongVol

Weekly Market Notes

A plain english summary of what the week ahead looks like.

So here we are again, a new year and new opportunities. I wrote in an email a week ago this idea that I subscribe too of breaking the years up into quarters. It’s now a new idea for investing/Wall Street but I think it’s one that, when adopted, allows you to measure performance and to keep one on track. Q1 last year was really busy across the board and it started the worst year the markets had since 2008. But to me, and those in DeltaOne, it doesn’t matter because alpha is not static. If you’re new to reading these reports you’ll hear that a lot this year and it’s something that I use in my personal beliefs when investing.

Up/down/sideways, low volatility, no volatility the way I see it is that there’s always opportunity to generate returns. But one thing that has always helped me to invest/trade is to attempt to operate within a framework. Be it the investing framework I use to find and execute on ideas or a framework that takes into account macro/economic policies; they are essential, at least for me. So last year understanding what the Fed was doing played a major role in the framework that I applied quarter after quarter. For some, not realizing that is deemed to be detrimental for returns.

So that being said let me get into what I believe could transpire into Q1 and discuss my framework.

Howard Marks released a note a few weeks back called ‘Sea Change’ and it was interesting to say the least; much of what he had to say I believed in personally coming into 2023. For starters, I do not believe that the trending US equities markets are coming back anytime soon. To be more specific - I do not believe getting back into the names that performed well the last 5-10 years is going to be a winning strategy, the Peletons, the Googles, Open Doors etc. - People have been conditioned to buy the dip and hold and we’ve seen that mindset explode with Index ETFs, arguably, since post 2008.

This is really important. If you buy growth names expecting the type of moves/returns that were present in 2020 etc. then I think you miss, or even disagree with, that idea that the zero interest rate era had nothing to do with it. I believe it had almost everything to do with it, hence the rise in certain hedge fund managers and ETFS like $ARKK.

But that is over.

When I came into the business it was the golden-era of hedge funds (2000-2008) and I remember, being young and clueless, seeing these rock stars make all this money thinking, “this is what I want to do”. But then we went to passive investing which is where we have been.

The era of active-management is back, the rockstars are back.

Now I could be biased in saying this as my own incubation fund opens up here in Q2 to outside investors but this is my perspective.

Rates and inflation are at the forefront right now and it’s affecting the world at large and until there is some type of change there this is the framework to which I am going to operate within as we head into 2023. Energy should be a big theme to start the year and I think, as of now, we might get back to single-stock selection again and hopefully, a rise in spin-offs.

I also think there will be a large rally once we find the lows, maybe near $3,300-$3100 on the S&P 500.

Will it be the low? Who knows. Who really cares. I don’t expect it to be and I don’t go into this year expecting to apply that 2009-2022 playbook of buy, hold and wait anymore. Maybe there is a world where you can look into what 2024/2025 could bring for certain equities but for me, as of now, my focus is on Q1/Q2 and raking in some alpha to start.

I took the last two weeks off of the year so just pulling up to the terminals this weekend was refreshing but we’re not NFL players, NBA players or in Formula 1 sadly; there is little to no break for us.

The scoreboard is reset to 0, so let’s get into it.

The Week/Month Ahead

Non-Farm Payrolls are Friday as well as FOMC Minutes Wednesday so that should kick off the year with a little volatility to start so let’s see what that brings.

I am curious to see what managers come out and do what to start the new year - where do they position, how heavy are they coming in etc? Not because I care to piggyback them but because I want to see what the overall theme they might be running with to start Q1 is. Given the fact that 2023, for many funds, was atrocious, and provided they were not redeemed, I imagine they want to come out and perform into Q1.

That’s at least what I would want to do.

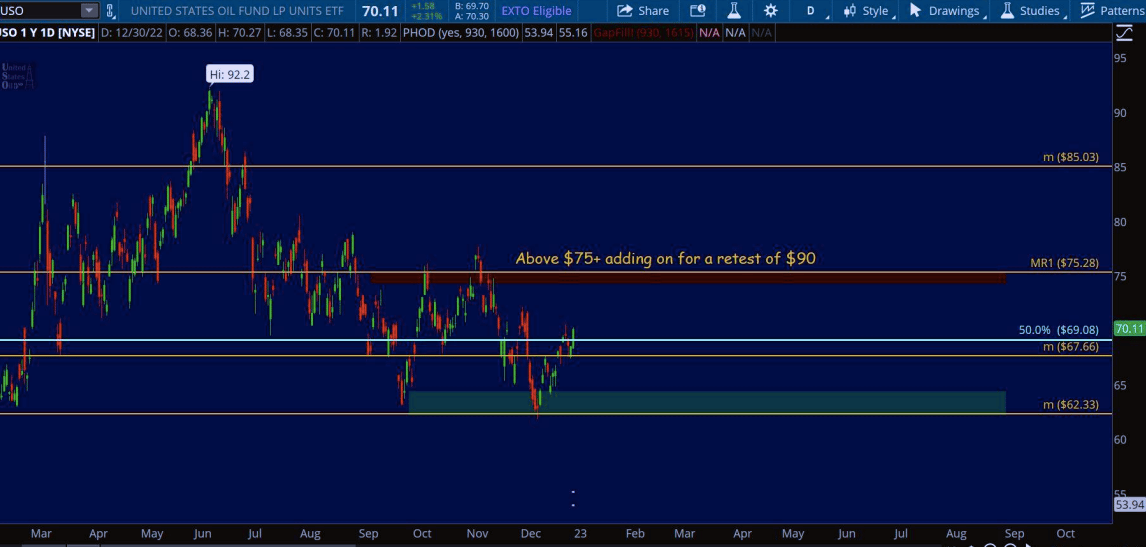

To start this year I am bullish on energy names, especially to start this month. Whether that is long $VAL, $XLE, $USO or WTI CL calls, the play is there to set-up some nice moves to begin this year, especially if China demand comes back online with reopening.

There’s also Netflix which is set to kick off earnings here in a few weeks so that has my interest as a gauge for some similar names in that space. While I don’t expect the numbers to be great I want to see how the market reacts to it as a sentiment read. Some of the names in the FANG Tracker are lighting up and there could be a tidy little week inside there on a few of them to kick this year off properly.

There are a lot of new ideas in the Swing Trade Monitor right now that I am really liking. A few names in there are new to me trading into but given what happened last quarter in select equities it’s presented opportunities that look great.

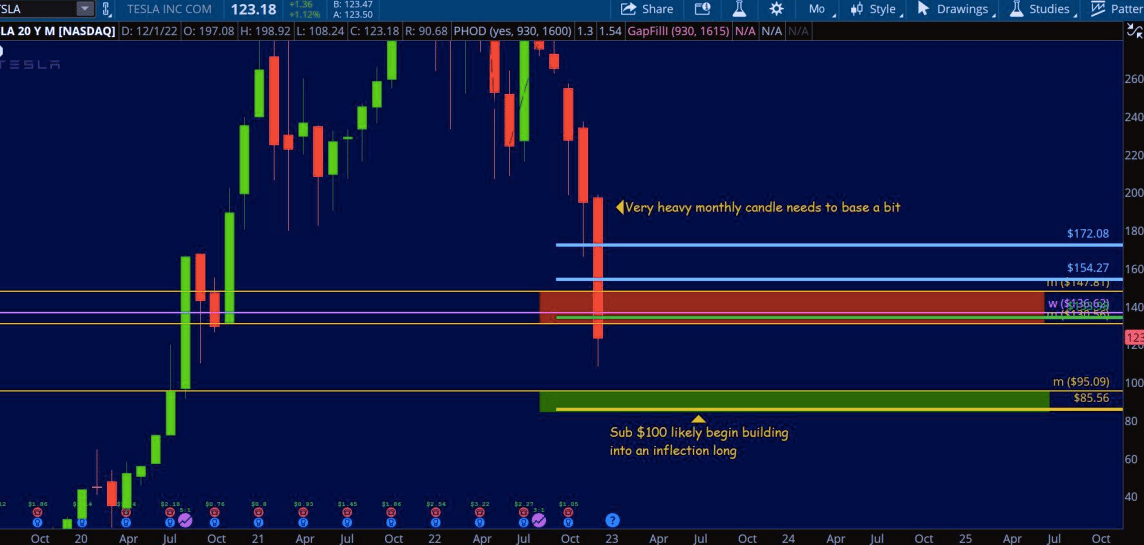

While I watched Tesla get demolished the last few weeks and kicked myself for taking the time off I remember that there’s always another trade. The world is watching that right now and I really hate to get into names like that where too many eyes are on it. I have an opinion on the company fundamentally but I’ll save that for later. Technically, I am a buyer if we trade $100-$90s but before then there is zero interest to even consider this as a play right now. $140/$50 could technically trade on that chart so maybe I’ll short it back down, we’ll see, I’ll get into more on this in DeltaOne in the coming weeks.

There is not much I see in the way of short-trades right now and I do think overall the S&P 500 needs to bounce a little, at least to start the next few weeks. But again, the Fed speaks at the end of the month and while I don’t expect a change in policy let’s see if the market buys into the hope and dreams of a rate cut again this year.

Dan's Cliff Notes for The Week Ahead

Fang Tracker: $NVDA, $GOOGL, $AMZN all have great setups so let's see what we can do.

Swing Trader Tracker: $HASB and $C look really good. Genuinely those are great setups I would position into. $AAP is included in this as well.

Event-Driven Monitor: H&R Block might set up in coming weeks for a great play. Note this.

Futures/Commodities: S&P 500 looks like it is ready for a little ramp this week. NFP Friday is a big deal.

ISM Data on Wednesday

FOMC Minutes Wednesday

NFP On Friday (big deal)

Close eye on Oil this week

Pay attention to Swing Ideas

The FANG Monitor

Tracking high-beta FANG names that are popular for short-term trading.

The Down & Outs

Stocks that have been sold off with potential for short-term inflection buys: usually 1-4 weeks holding time.

Value Stocks Monitor

Stocks that are deemed to be value plays as defined by some or all of the following: institutional ownership, low P/E ratios, some fundamental catalyst that may unlock value.

Event-Driven Monitor

Stock buy backs, spin-offs, catalyst driven or special market situation themes can be found in here.

Top 2 Charts for The Week Ahead

The top 2 charts that I like for the week ahead with notes. These are not investment ideas. Please use that thing between your ears before making an investment decision! The Premium Report has full access to annotated charts and the community.

Notes: $USO. Bullish flow on this technically and fundamentally adding above +$75.

Notes: Tesla monthly chart still very bearish. Would like to be a buyer sub $100 first.

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.

DIY Investor with more than $50,000? Consider joining DeltaOne.

Too Busy to Research? Check Out The TLV Report.

Thank you for reading. LongVol grows through word of mouth. Please consider sharing this post with someone who might appreciate it.