What is The DITM Portfolio - AKA AST Alerts?

In this post, I am going to break down deep-in-the-money options and the practical application to using them in a medium-term (swing) portfolio for long/short trading. We apply a DITM structure into the $100K Portfolio that I run based off of the research that is within the LongVol Report.

The DITM Portfolio has a few intended applications:

Lower-volatility trade ideas that last 7-90 days on average.

A capped risk profile of 4% per trade on the $100K portfolio.

Use our research and allow us to structure the ideas for you.

Directional P&L generation with lower capital outlay and leverage.

This 6-page PDF explains the AST Alerts and examples of what they look like and what to expect.

You can get a 21-day free trial to see the portfolio, past alerts below.

Understanding DITM Options Application

1. What are Some Narratives about Options?

Let’s do a quick primer on options and get past a few narratives so that you can hopefully look at this objectively.

Options are risky.

Most retail trading is short-term options.

I don’t understand how the work.

Those are 3 common narratives.

Options are risky if you use them to sell naked calls or other strategies that put your account at risk. That is an objective truth.

Most retail trading is in short-term options. That is an objective truth. (Source)

I don’t understand how they work. Like most things, you can figure out how they work by spending a little time too.

In this case, go directly to the source to avoid the narrative (which if you watch that webinar above) usually gets spun.

This is the Chicago Board of Options Exchange - education here on options.

2. What are DITM Options

Deep in the money is an option that has an exercise or strike price significantly below (for a call option) or above (for a put option) the market price of the underlying asset. The value of such an option is nearly all intrinsic value and minimal extrinsic or time value.

That’s the answer - objective truth.

Now how can they be used to benefit a portfolio to structure an investment thesis?

This is where subjective opinions come into play.

So, this is important and where I think most get lost on this path to figuring out whether or not there is a benefit to their portfolio.

I’ve used them for over 5+ years, in certain situations, to allow me to express a view on an idea long or short and I’ll share some benefits.

3. Example One Benefit: Stock Replacement

You find a stock or company you believe in but your portfolio might be:

A) Smaller ($10-$50K)

B) Has it’s cashed tied up in other investments you like

The point is this: your capital/bankroll is limited or risk-averse so you want to maximize the use of your capital while finding fixed risk and leverage.

An option will do that.

And when done with DITM options it can produce a smooth equity curve.

Buying Apple Shares Directly

Assume you wanted to buy 100 shares of Apple at $179.50 for a total of $17,950.

Assume that you have a $100,000 portfolio.

That becomes 18% of your capital allocated to one idea - that is neither good or bad but for the sake of this argument, that is a lot of risk in one idea.

If the stock moved against you -10% you would be down $1,795 - again that is not a big move and fluctuations are expected when buying a stock.

The DITM Call - Stock Replacement

You could buy an April 2024 155 strike call for $28.60 or $2,860 instead.

Your max loss (fixed cost) is capped at $2,860. The worst that happens is you lose $2,860 because you don’t have a stop-in or just forget.

Alternatively, if the stock moved against you -10% that option would lose (give or take) $300-$500 in value.

The Traders Perspective

If you look at buying Apple from the idea that this is an investment, then don’t use DITM. Buy the shares, hold the shares, and do as you will.

My view: I like to maximize portfolios and leverage capital WITHOUT extra risk.

A DITM call like this does just that by allowing you to replace owning the shares with less capital outlay and less portfolio risk while giving you leverage.

I am trading the move, not investing in it.

So if that call moves +30% for me or +$858 that is a great trade. ($2,860 X .30% = $858)

If the stock example moves +10% for me I would make $1,795 - also a great trade.

So, it comes down to a few things:

Do you care about overall portfolio risk? If not, buy the shares.

Do you want to control the downside risk? If so buy the DITM option

4. Example Two Benefit: Short Selling/Betting Against Price Falling

Assume you want to bet on a long-term thesis that something will trade lower. For a real-life example, is housing stocks as of recent.

A year ago, Carvana was short - and part of my $1,000,000 trade was using DITM options to express part of that view.

When shorting a stock with the actual shares you encounter:

Borrow fees (sometimes high)

Portfolio risk because the stock can be squeezed.

Margin

All of those are objective truths. What is subjective is whether those are bad or good, that depends on who it is.

For a retail investor (again using the $100K account) it’s dangerous because you put the portfolio at risk.

This is where a DITM Put can come into play.

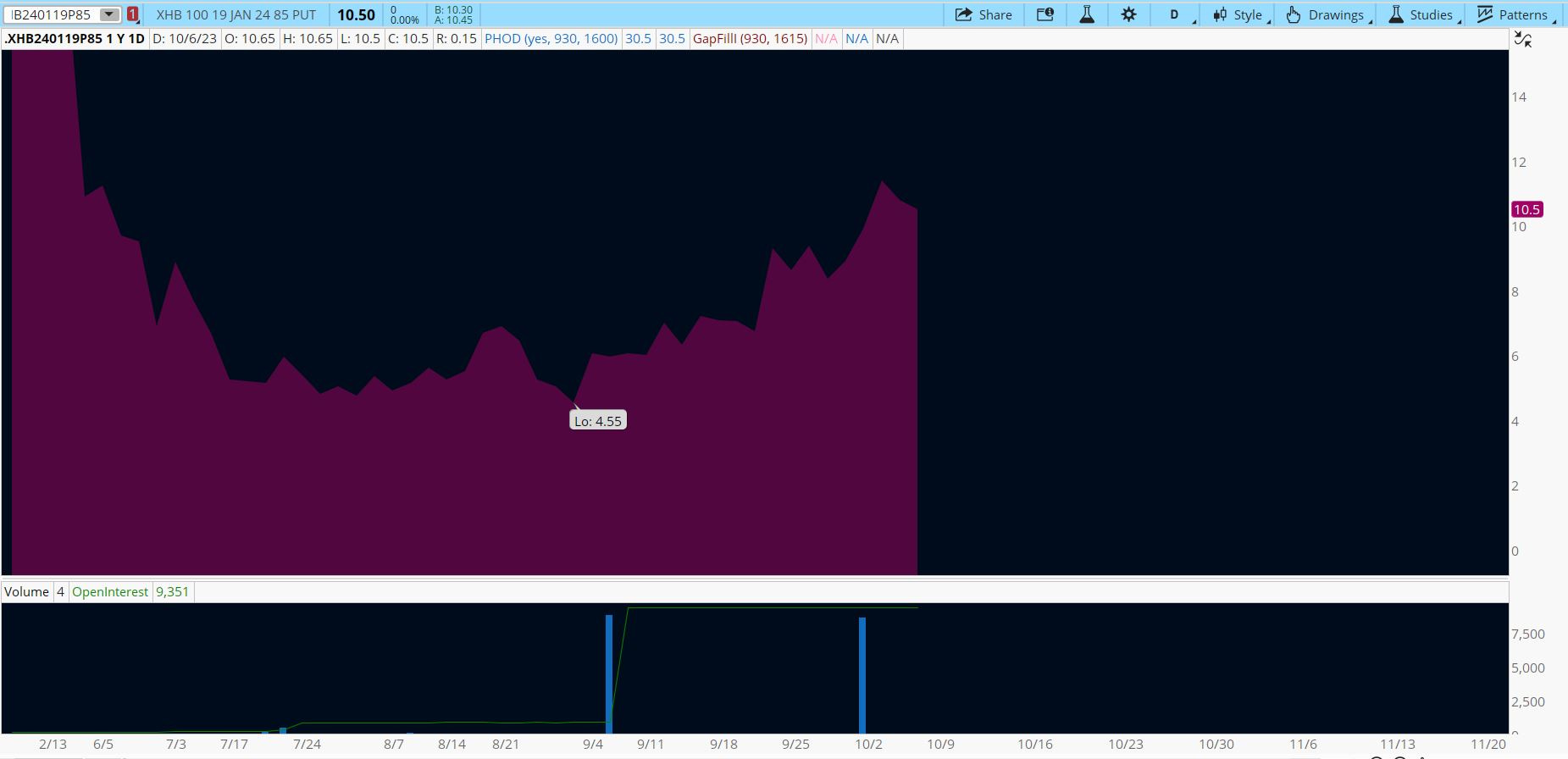

That’s XHB - a home builder ETF and a current example that I have a short on and some of that short is with DITM Puts.

The ETF is down from the start of September to about -10%.

The January 85 strike put which was trading at $4.55-$6.00 near that time is trading at $10.00-$12.00 at the time of this post.

Shorting the ETF v. Buying the DITM Put

Shorting the ETF would at $85 would cost you $8,500 + any margin required to hold that position.

So again, on a $100,000 portfolio that’s only 8.5% of total portfolio capital.

That is neither good nor bad - this is subjective opinion on portfolio risk.

Buying the DITM Put -

Assume you bought 3 of the DITM puts at $6.00 for a total cost of $1,800.

Your max loss is $1,800 (again without a stop).

But this idea worked so say you sold at current price of $10.50 for a gain of +$4.50 per contract.

That total gain is $1,350. That is a $1,350 gain with capital outlay of $1,800.

That translates to 1.8% of the portfolio v. 8.5% of the portfolio.

So risk-adjusted, which is the better trade?

Objectively, the DITM put trade.

5. Final Notes

Let’s summarize this quickly.

DITM options reduce portfolio risk (subjective opinion)

DITM options allow you to bet on prices dropping lower with puts.

DITM options allow you to express a long-term view without the volatility of buying the actual stock/etf

DITM options allow you to maximize the portfolio with leverage that does not require margin or the risk of naked call selling or other dangerous strategies.

There is a framework that goes into using them and not every situation/stock requires them.

You can use the research that we develop using our top-down, systematic approach to access the AST Alerts.

You can access a 21-day free trial now.

This article is presented for informational purposes only, is an opinion, is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.

Please comment here if you need clarification or want me to expand on anything not covered!