First, congrats to everyone on Rivian. That was idea flagged in The LongVol Report in January, executed on in Feb. - You can see the whole thing here.

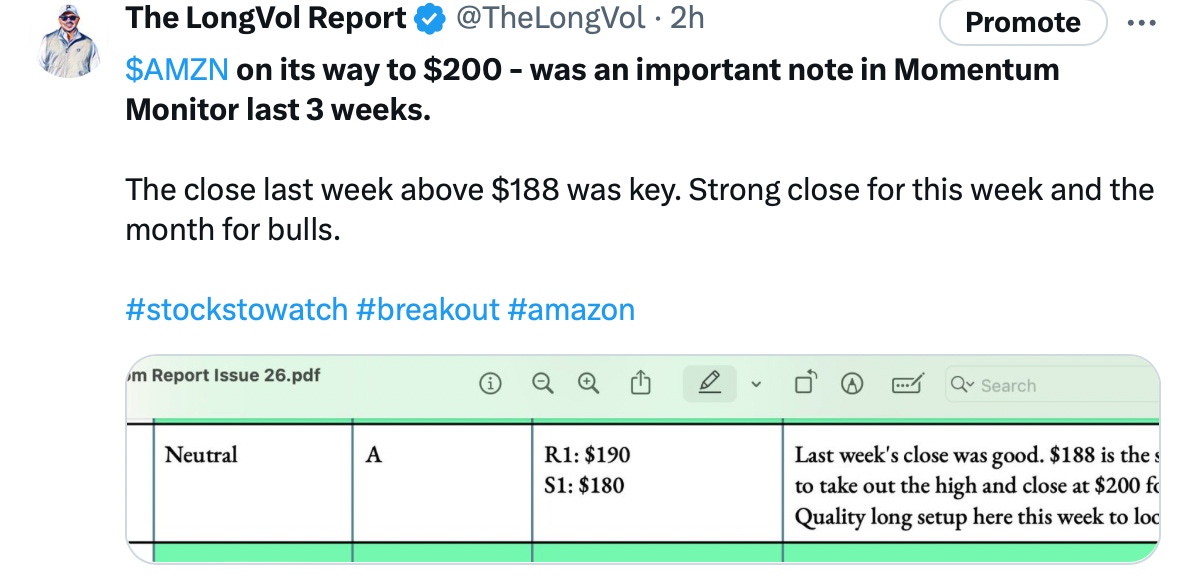

Amazon is breaking out too and for those swinging that we’re on course to hit targets mentioned in the report. $210 is the target and this really was a “layup” long into the end of the quarter because it seems to be “the only game in town”

First, I know a lot of you read this and don’t subscribe (I know because I get emails and questions a lot from non members) and for the life of me I don’t know why.

This report has been on fire this year and really the last two years if you followed the ideas, and I say that humbly.

It’s not my job to make you all drink the water but I can show you where it is and it’s been raining alpha in this report for a long-time if you just read, pay attention and in the case of Rivian, stay patient.

My past was coaching retail investors (massive headache) - I decided to end that in 2020, came back a bit to it a year ago and sort of ended it again. As I get back into Portfolio Management my job is educating clients on what we do so they understand it clearly.

But, a few years ago, when I shorted with Carvana, I had dinner with a friend (CEO and PE guy) Howard Lindzon in Phoenix. I remember telling him my plan was to go back to money management - he tried to dissuade me and said that YouTube is where it’s at “Investing as entertainment” he said, and, he was and is right on that idea.

But what he also said was in regard to his own career running a fund (as a PE guy and the general partner) - The story he told me was when they were A round investors on Robin Hood HOOD 0.00%↑ , they made a lot (9 figures + a lot) - but even then, he had to talk to LPs to not sell when the position ballooned.

I share this story with you all because at any level being patient is hard at any level; being a retail investor, being an LP (limited partner) or being a fund manager - it’s always hard to be patient. But, in some situations it’s key and with most things in life things just take time.

As I get back into this business as an Investment Manager it excites me and positions like Rivian are “Non-Core” portfolio positions that provide asymmetric wins, and sometimes, they just take time.

There are no links for reading today. I am in Rincon, Puerto Rico working on some items for the end of the quarter.

If you are not a subscriber to the TLV Report and AST Alerts you can start a free 21-day trial here and should you, we have a members webinar tomorrow night at 6pm EST.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.