Rivian & Assymetry

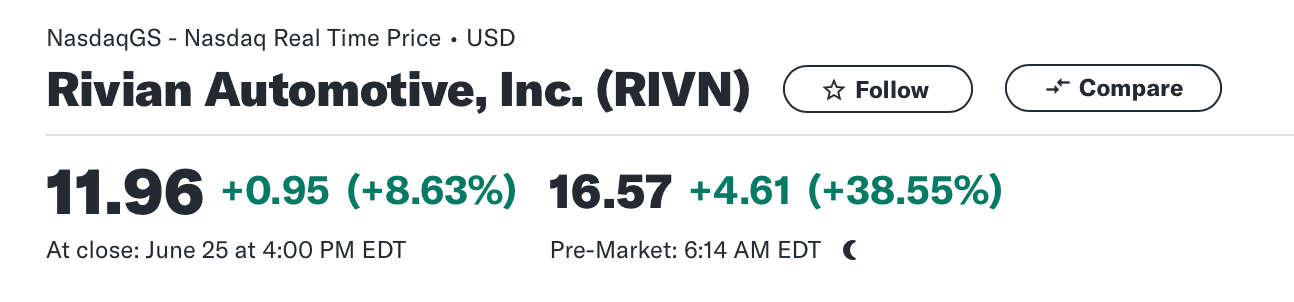

Rivian is up nearly +50% on news of a $5B investment from VW and we are nearly at $16.50 as I write this. This was a small position for me that I basically wrote off, but as you’ll see here, that was the point - to put it on and not think or worry about it. You can see my full notes and thought process on this below and see how members of AST Alerts received the idea, which was multi-strike/leg with some using LEAPs too.

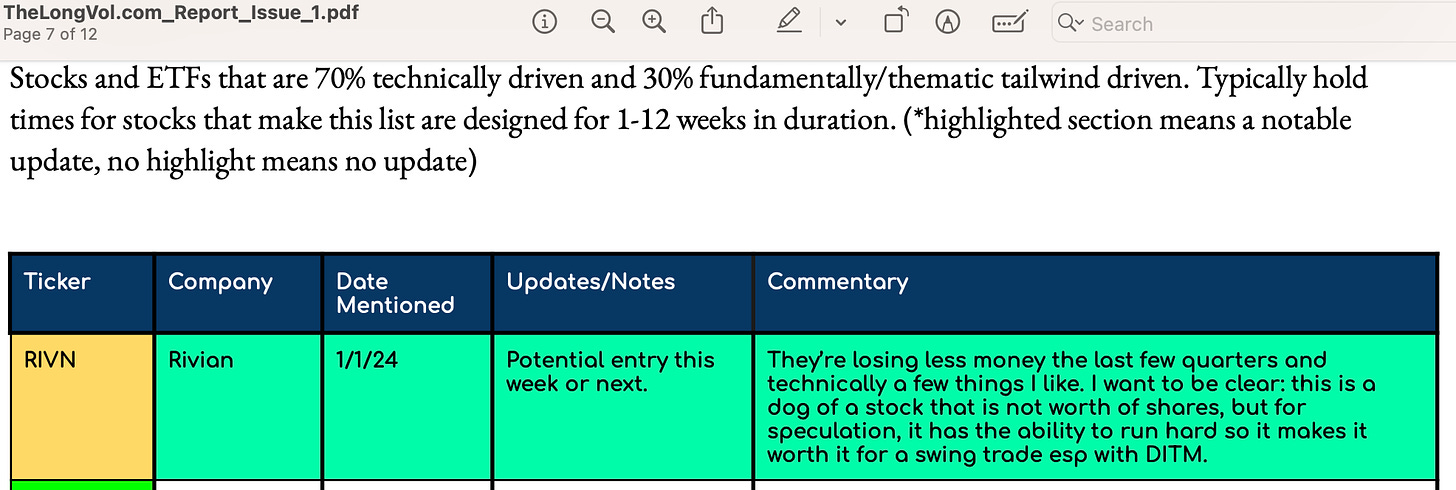

In issue one of The TLV Report I added RIVN 0.00%↑ to the Swing Monitor with a few notes.

The Monitor has 4 stock trackers:

Momentum Monitor

Swing Monitor

Boing Boing (Left for Dead Stocks)

Special Situations

(Issue 1 January: Rivn added to Swing Monitor to track)

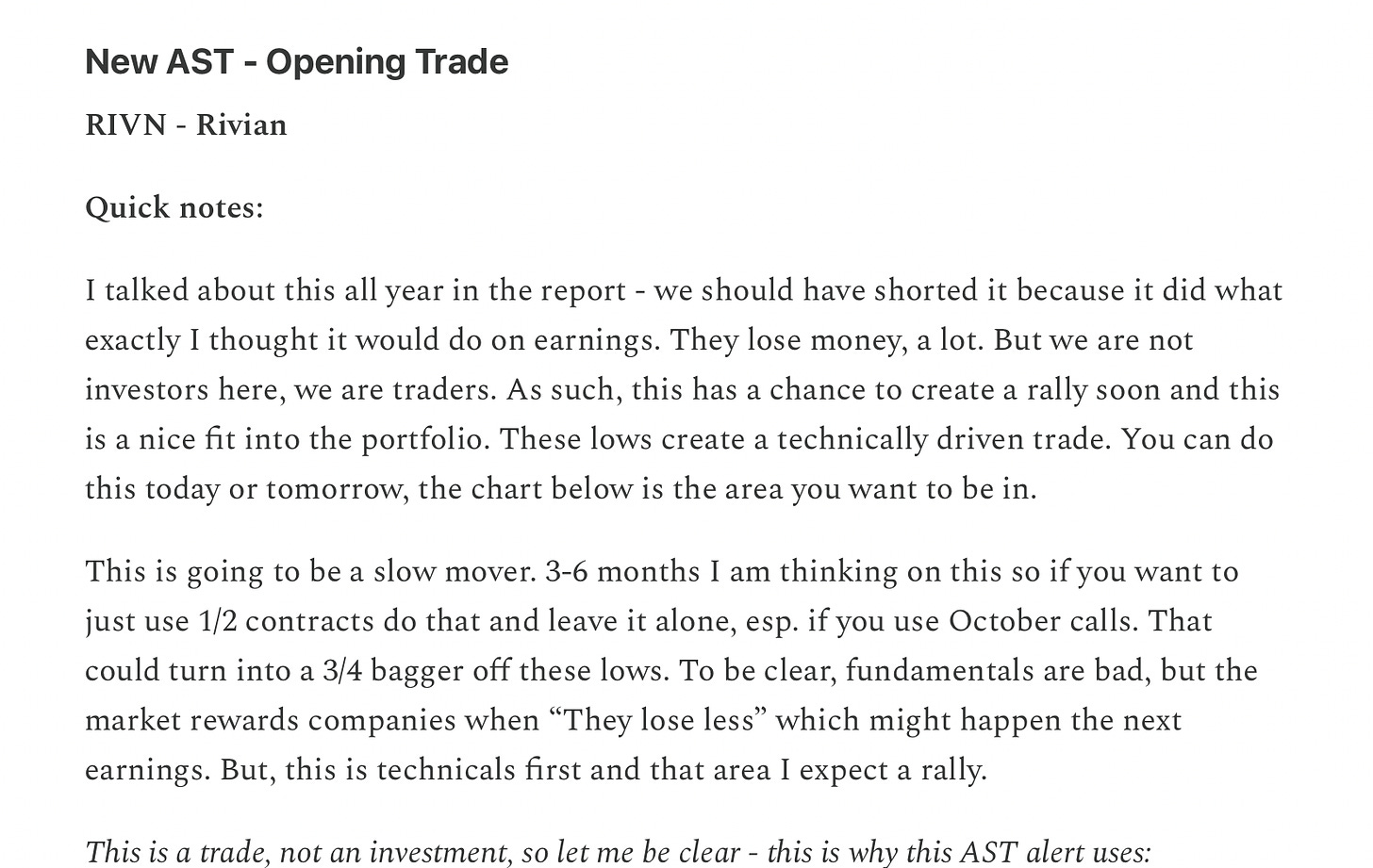

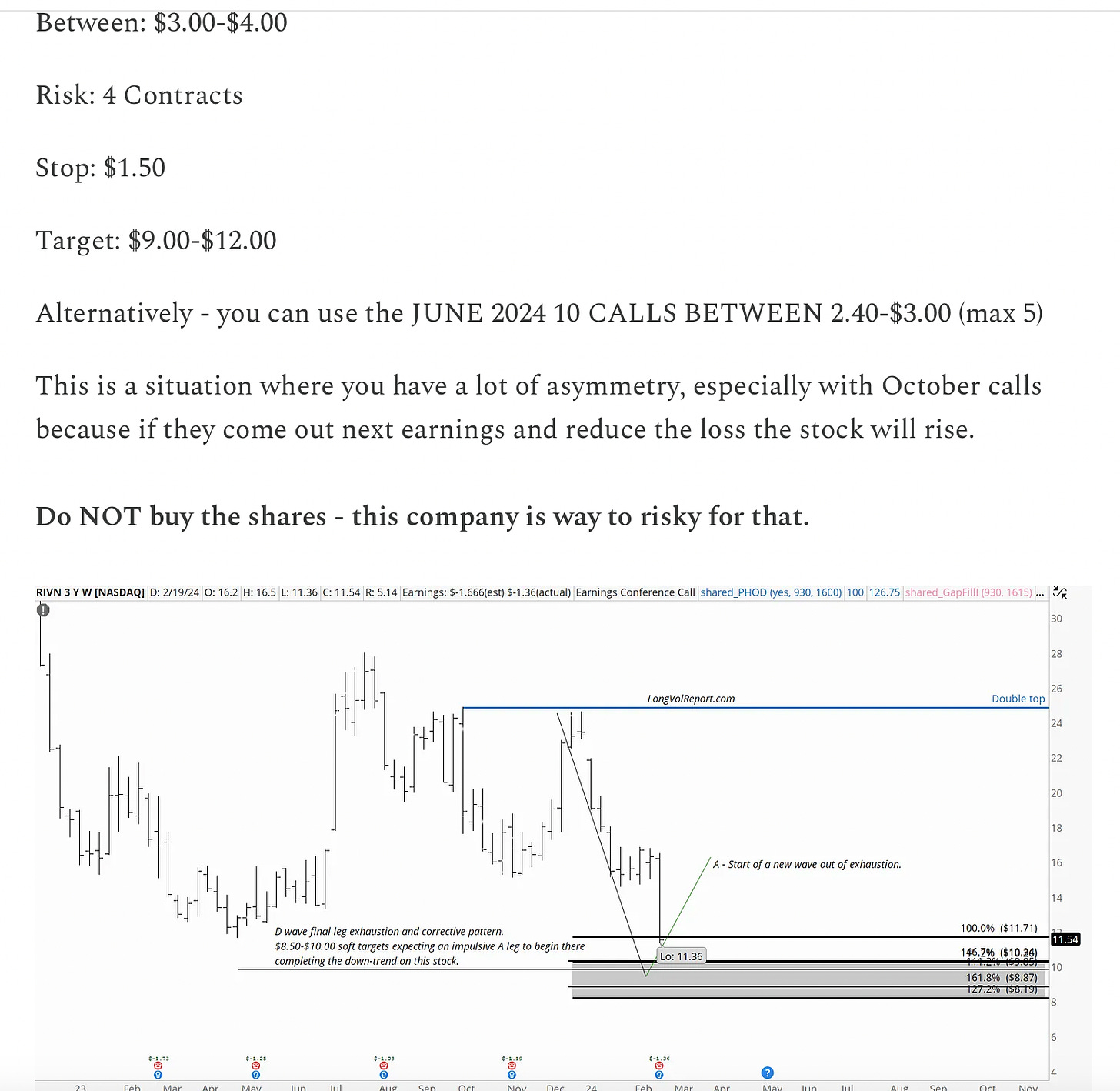

6 weeks later in February I put out an AST Alert for members on the trade to use Oct $10 calls with the option to use June Calls as multi-leg trade. Some took this trade out using LEAPs as well and all of these legs are going to be up pretty big so congrats.

Small position: big upside. Sometimes certain ideas are just that and Rivian was just that idea - if they could “lose less” or have some material change then we could see a 3/4 bagger off the lows.

If you are not a subscriber to the AST Alerts and LongVol Report you can download a free copy and get a free 21-day trial here.

Asymmetry

I wrote about this idea back in 2021 and have been using it my entire career.

There are a lot of views on how to run money and those views change based on the amount of money you’re running because you can only do so much.

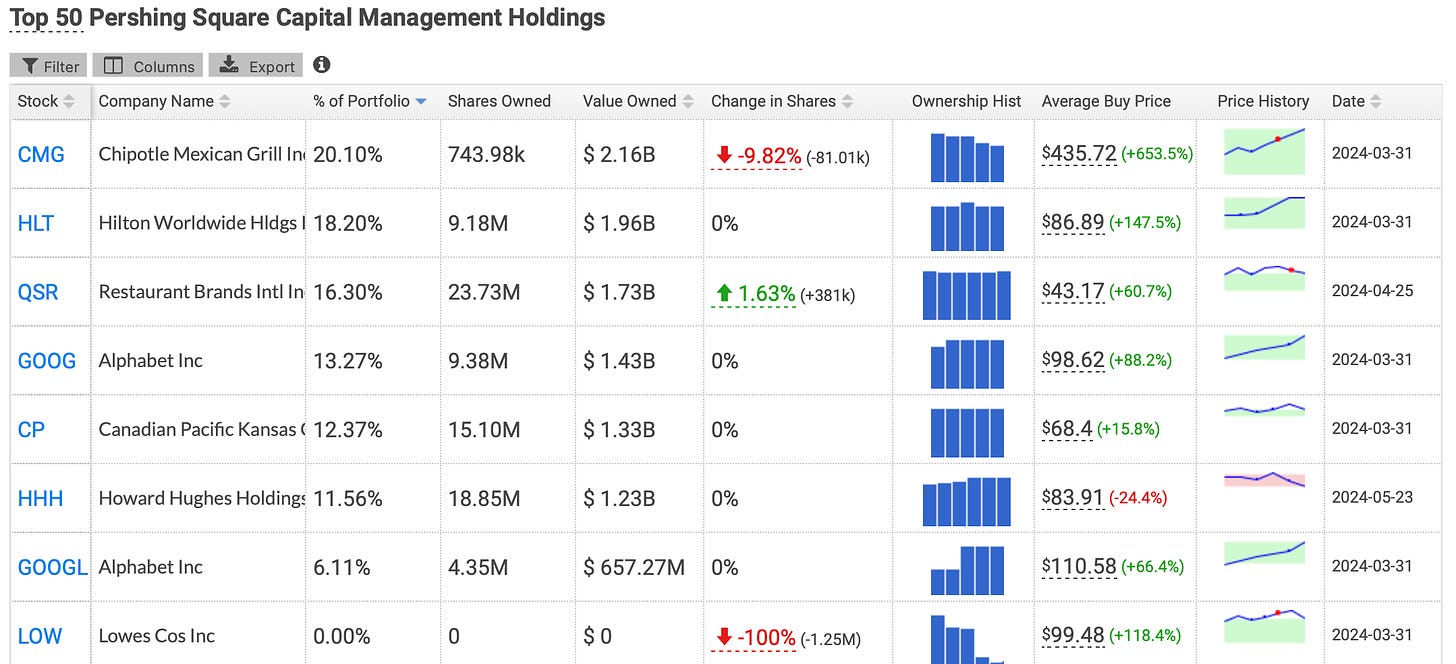

For example, Bill Ackman, of Pershing Square, runs a very concentrated portfolio.

He also had a big asymmetric bet where he made $2.6B off a small position.

The point is that asymmetric positions don’t have to be a thing for you and there is no right/wrong way to run a portfolio - it’s what makes the market so vast for investment managers because everyone see’s it differently.

But, in my view, you need a balanced book + asymmetry to make it all click.

Rivian was and is not a Company that I really believe in - I was not shy about it above as you read and made members very clear on that in the AST Alert that was sent out in February. But what I am a big believer in are two things:

Asymmetric ideas in a portfolio to add upside

Weighting positions accordingly

Not every idea has to be a home-run and not every idea has to be sized small, each situation has its own nuanced information and each portfolio has its own risk structure. What I mean in simple terms is this - Bill Ackman Running $5B or whatever it is v. someone running $5M have to different views on money.

For me, when I run portfolios, I am not after 10% a year - we’re either going to try to make serious money or it’s just not of interest to me to mess with. And sometimes to do that, you need asymmetric ideas like a Rivian.

The rest of the time it’s just usually grinding out quarter by quarter, cycle by cycle and then you get a shot at ideas like this. And ideas like this never have to be portfolio-weighted heavily (amount of money compare to the size of the portfolio) but they can be small risk and you can just put it on and forget it, which I did on this name - really.

Not saying you expect to lose on the idea, but you almost have to so that you don’t try to watch it each day. The position serves a purpose in the entire portfolio and if the rest of your “core” ideas that you like work out then even if a small asymmetric position fails it shouldn’t matter too much.

Congrats to the longs and subscribers again.

I’ll cover this in the weekly show. You can watch/listen here for those new.

📘 Want more of this? Read Trades v. Investments

🕝 Get the TLV Report & AST Alerts Get a Free 21 Day Trial

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.