Beige Book data was today and that was the data I was after. Here is a quick summary:

'National economic activity continued to expand from early April to mid-May, although conditions varied across industries and districts.' 'Overall outlooks grew somewhat more pessimistic amid reports of rising uncertainty and greater downside risks.' 'Prices increased at a modest pace over the reporting period.' 'Employment rose at a slight pace overall.' 'Eight Districts reported negligible to modest job gains, and the remaining four Districts reported no changes in employment.

That was enough to have buy-side flow today stall and I’ll get into that in premium with the SP500 outlook.

CRM - The stock is down -10% after-hours. They had decent numbers and raised the EPS guidance but revenue missed by 0.1% and GAAP margin was guided lower. Whatever - the point is now that you have this lower there is a trade potentially long here into the end of the week around $215-$220 area. That is my technical spot to watch for a trigger to get long. Again, to be nuanced in this - I am not buying the stock to hold, there are better holds (Subscribe to the AST Alerts) . Most amateurs that punt around in global stock markets see this and buy it to hold with little to no diligence - let’s be real, that’s exactly how it goes down.

What I care about is very simple:

You have a volatility crush on the calls tomorrow and they should re-price

The put premium will explode

Technically $210-$220 area has a high chance of finding support and a rally

Now, how you trade that is up to you - I have a way of going about it but the recipe is vol crush + technical support = potential short-term trade. Those of you who read this site free - don’t brush this off because it’s not simple enough, take 5 minutes and understand what that term means and explore the idea of trading stocks post earnings, or don’t.

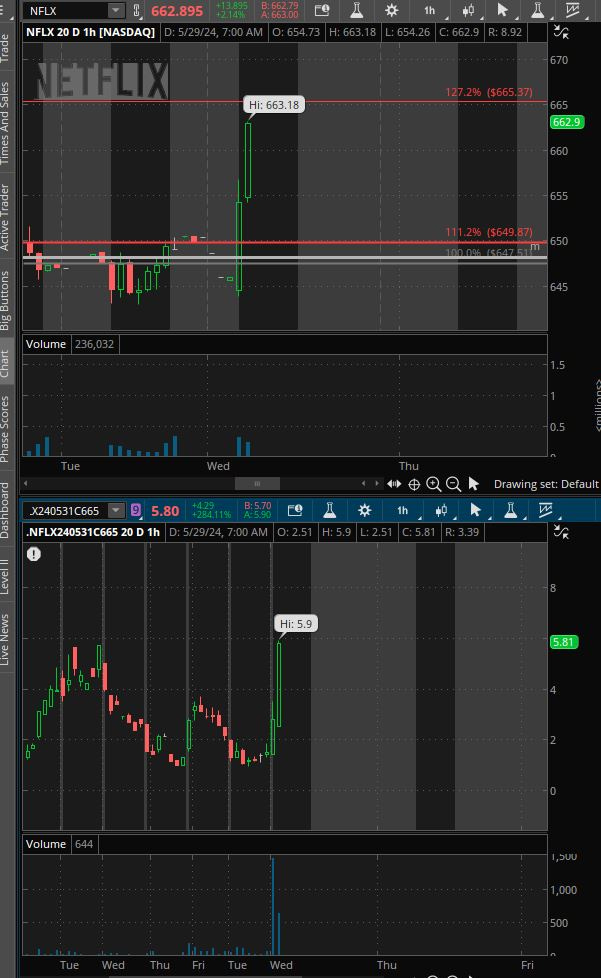

NFLX - I’ve been hot on this all week. Discussed it in the Premium post last night and we ramped today right off the open before hitting the soft-target one. Very easy trade today (really- you literally just need to subscribe to the report) to take with a clearly defined target. The best part? You didn’t have to sit there and model options data or look for sweeps to pretend it is you know what you’re doing.

Let’s get into the recap for tonight to talk about this CRM post-earnings concept I just explained in detail and then do our regular market breakdown on SP500/Nasdaq and a few ideas tomorrow if this data at 8:30 is bearish and drops us lower which is a possible on a lot of names given that close.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.