The economic data just is not improving and it started with CPI a few weeks back - wages are stagnant, GDP is flattening, money market outflows are heating up and credit card delinquencies are higher.

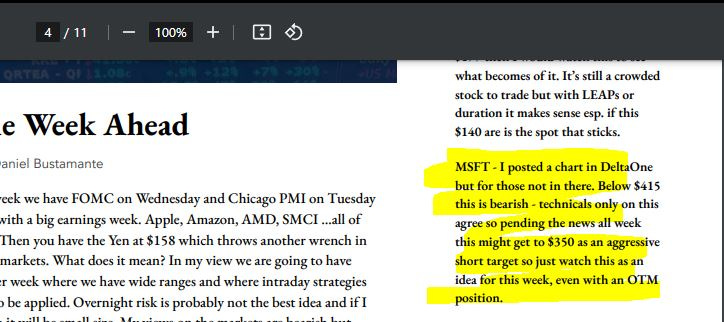

The earnings last week from MSFT 0.00%↑ have sold off and are now off about -$30 from the highs as of today. If you put down the garbage most of you read and read the report I sent out Sunday this was a top 3 idea. I’ve been short that since last week and covered the majority of it today but kept a lot of the equity short if SMCI 0.00%↑ AMD 0.00%↑ and AMZN 0.00%↑ earnings dragged the market lower.

Currently, SMCI -7.14%↓ is at $790 after printing $940s, but it’s where we open that matters.

AMD 0.00%↑ is at $151 and AMZN 0.00%↑ is flat at $180 after testing $186s.

GOOGL 0.00%↑ is also off the highs from earnings and if $155s break there’s a problem.

But, that’s the point - the market is under duress, fundamentally and technically.

I discussed some views on it last Saturday here.

A friend who works in the business once told me, “No market is an “ and I could not agree more.

I expected that earnings COULD lift/pump the market but we didn’t get that. Now, tomorrow, we have FOMC, a new monthly candle, and data for the rest of the week.

Moving on….

S&P500 broke $5100-$5190 which was and has been a key spot and given the poor economic data and failure to pump from earnings I think, finally, we may have our free reign at shorting into May - In fact that is probably the move even with a bull trap tomorrow. However, there are some things to cover before that which I am going to discuss in the recap video and trading notes tonight.

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.