So Easy a Caveman Can Do It

March 2020 started a new era of rules for financial markets and ushered in a new era of traders and advisors alike, or so that’s how I see it, and if you look at the chart of the CBOE 0.00%↑ that will show you the data to back it. Not only did Covid remake the world at large it remade the global financial landscape as well putting us, in part, into this mess we find ourselves in now - and if you don’t see a mess then you’re just not attuned to what is going on because there is one brewing.

COVID was just gas to a fire that had already been raging from a decade prior of easy money where every advisor could just passively index a client and sit back, it was so easy, that a caveman could do it.

About this same time two years ago I wrote “Say Goodbye to Passive Management” here on this blog.

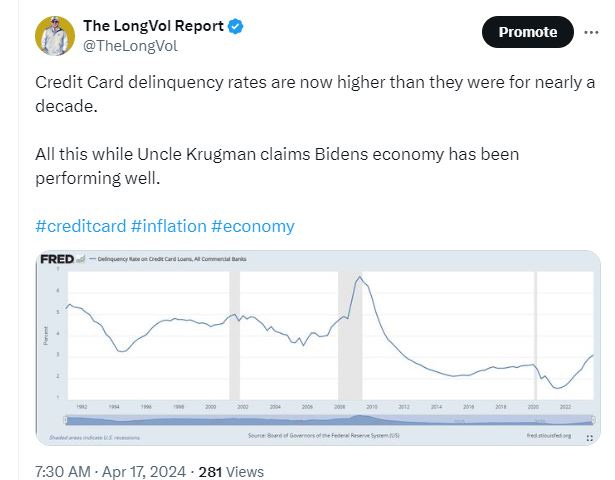

Not much has changed since then from my comments but the Prime Rate is now higher and inflation is likely starting again - despite what Uncle Krugman is trying to gaslight everyone into believing. People are still (aside from the ultra wealth) getting hosed with the cost of living and inflation running amuck and I speak with friends who make north of $250/$300K a year who are still struggling to make it work, albeit they have kids etc, that still just doesn’t seem right.

Admittedly, it took me a while to connect the dots of what the effects of 2020 would do to the markets with the amount of money coming into the system. I made money but not to the effect to that I really should have and that matters if this is what you do for a living - it’s just not acceptable to miss like that especially when it was a layup. But, macro was just never my first line of thought process when it came to financial markets primarily because I was always short-selling, value hunting, or trading inflections off price-action for the most part up until then. But, with all things, you have to evolve as the pieces of the puzzle on the board evolve or you’re left in the cold.

That chaos that started then has led to what we’re seeing today in both crowded trades, broken market structure, and lazy-investing from advisors and retail traders alike. You add in the non-stop deficit spending the US Government is doing along with Middle East tensions, a drained SPR, and the FTC cracking down on deals and it makes for a very interesting economic landscape.

But, it doesn’t end there. The US consumer is part of that deficit spending as well with credit card delinquencies higher than they were a decade ago - something I talked about a week ago on the WDYMTW post.

And that matters. Just as much as it matters with deficit spending and the effect it’s going to have on bond markets, not only here, but in other markets as well, and inevitably, the Fed likely has to step in to help that out just like they have with every situation we’ve had for now the last 15 years. Not that I am a big fan of the guy but Ken Griffin recently came out talking about deficit spending getting out of control and when that guy has something to say about it, I think everyone should at least have a listen.

If this sounds cynical to start, it is, but that’s what’s required in this new era we’re in batched with a healthy dose of understanding history so that you can see the potential moves that are next to come on the chess board, whether that’s from a macro lens or a market-structure perspective which I am getting to shortly. The thing is, nobody wants to talk about this stuff because it’s taboo and you certainly cannot talk about this on mainstream financial news because you have to stick to the script. Not that it needs to be said but on any financial news network the script is usually the same, like I say, “It’s just a movie on rewind” which is why on every sell off they have a financial advisor on talking about bullish talking points to calm the herd.

Most news networks did that last week and this week and after a few days of rally things are calmed down, for now.

Optimism and Crowded Trades

That October rally we saw was a return to the pre-2020 enthusiasm for markets as every market participant with a Robin Hood account and every real-estate agent predicted: “rate cuts” and with that the market got ahead of themselves like we always tends to do. Nobody piled into value names or energy (from what I saw and heard) it was a crowded move into tech names and the Mag 7 (plus some for the nitpickers reading this). It wasn’t really until the start of April that mainstream media and pundits talked about oil being longs and right at the time when we were exiting most of them from Q1. A few weeks ago there was a June WTI options trade that hit the tape with far OTM calls, 250 strikes (Bloomberg link). That trade, like many in this era we’re in, was lazy and one predicated on war breaking out. But, like most things, the market prices in the events and data well ahead of time, or at least that’s the idea.

Then at the star of the year you had all of those Mag 7 and semi-conductor names long. Everyone piled in and kept piling in from the October lows, they all became the standard hedge-fund hotel names. (Yahoo article)

While I missed most of that I piled into energy names and a few undervalued plays in HIMS among others. They produced quality returns and I patiently waited out the eventual exit from the crowded long trades that many got into. And why not? If you’re an advisor managing for 0.5bps or 1bps, or hell, even a pod shop PM, you almost had to pile into it or you were at risk of getting fired. If you followed the report in Q1 pretty much all I talked about in the momentum/short-term trading monitor was trading Nvidia shorts off the open and catching the liquidation from longs and toward the end of March started putting on tail-risk shorts expecting the blowoff, which we got last week.

In the money management business (whether a hedge fund or advisor) you can’t trail the index or you’ll look like a leper, you have to stick to the script and “play by the book” or you lose clients. Interestingly enough, last week I was in a securities exam for the firm and just watching a lot of new students come into this world with hopes to be advisors I could see in the main coach’s face that he knew some of the stuff in the book didn’t make sense, but, that’s what the test calls for. The problem is, the markets are not what they once were and the average mind is stuck to “beat the index” why not, that’s what everyone has been trained to do for the last 10-15 years - it was so easy that a caveman could do it.

Until it’s not.

And if I’m being candid, you wouldn’t catch me paying 2 & 20 for some bozo to index me or put me in NVDA either when I could do it myself so fair play. But, none of these managers are investing, they’re indexing clients, jamming into the same trade, and collecting fees all so that they can just survive. You almost cannot walk into any bank branch (or at least my experience) without someone there trying to get you to talk to a local branch advisor. Again, it’s hard to blame them because that’s what the system was built around and when you only think from that perspective then there’s no need to consider much else.

But, that NVDA trade in Q1 was epic, one for the books, and Druckenmiller caught that and seems to have exited perfectly as well. That’s hard to do, even harder with that size, but that’s why he is who he is. Trades like that, where the consensus is after an idea makes sense. Are they crowded? Yes. Do they have the investible blow-off tops? Yes. The thing is, like most markets, is timing. If you were a reader of the report at all this year I talked about trading NVDA, not trying to call the blow-off top and that proved to be a perfect intraday strategy for all of Q1 which led to nice gains.

One of the benefits (and I’ll discuss later in this post) of being multi-strat is the ability to be able to do that; to short-term trade as needed to drive returns. But, there was also the tail trade that made a ton of sense on that name as well, it just took timing and patience.

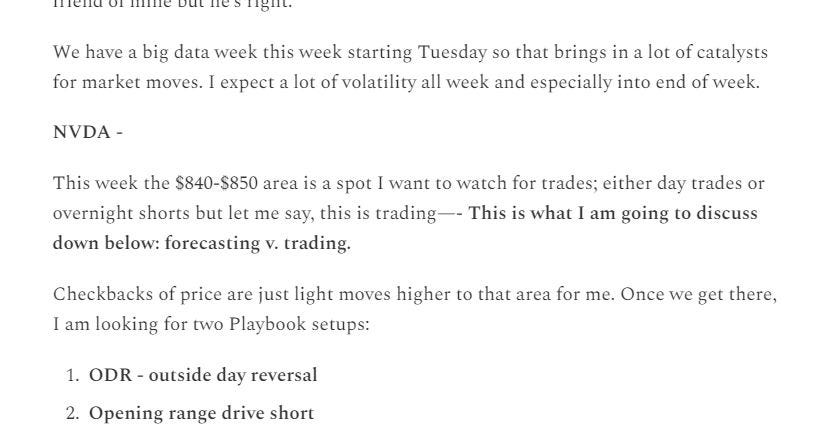

Does that trade get crowded again? I’m certain it does but with what we might experience this Summer with Fed policy in the bond market I don’t think it will return to that level of velocity to which it traded from the end of 2023 until that peak.

It Never Ends Well

I was not around in the 2000 tech boom, I was probably selling yo-yos or pogs in school, so I never traded it but I read about it as a student of the markets and in this era it pays to be a student of history. And today, interestingly enough, I was with a friend who was (until last week) a 30-year market veteran on the wholesale side who said something to me (I’m paraphrasing) but in short: The markets worry me because it reminds me of 2000, everyone is crowded into the same stocks and there are going to be problems.

I couldn’t agree more. And it’s not just the advisors either, it’s the retail traders - which, some of you know me from over a decade ago when I began talking about trading options on high beta equities. Today, that strategy is all you see from any guru online, in fact, I’d argue it’s the only strategy right now since most pump and dumps and micro/small caps are out of favor to the usual suspects, which, usually are in a high-interest rate environment. Everyone seems to be in the same trades and that’s all that anyone wants to discuss but they’re missing what lies in front of them, or so as I see it.

Let me stop for a second and say this: I am not here to say what is right or wrong, I am just an observer of markets, someone who just follows and adapts to the fuckery and landscape that is before us because it’s my job to generate returns, for myself, and for clients - and by any means necessary.

What you saw last Friday was just the start. You got a taste of what a crowded trade looks like across various names and it wasn’t pretty but that’s what you get when you’re in an era like this: I call it lazy investing. It’s the same lazy investing approach of the “just buy gold” crowd v. diving into other names that would surely benefit more on a YoY basis. But, it’s that type of thinking and that type of chaos you saw last week that becomes a source for alpha generation.

Why? For traders and managers not bound by HR or corporate investing restrictions, the ability to trade across asset classes long and short and to be able to rotate in and out of sectors and stocks as macro data changes is a benefit. Most simply cannot do that because they are handcuffed to regulations and rules around their firms. They are tied to the narrative just as the retail gurus are tied to the ODTE weekly options. There’s simply no room for creative thought, in fact, at the advisor level (especially wirehouses) that’s usually frowned upon because you have to stick to the script.

Last week Bloomberg wrote a piece titled: “Hedge Fund “Pod’ Strategy Imitated by Pension, Endwoments’ - you can read that here.

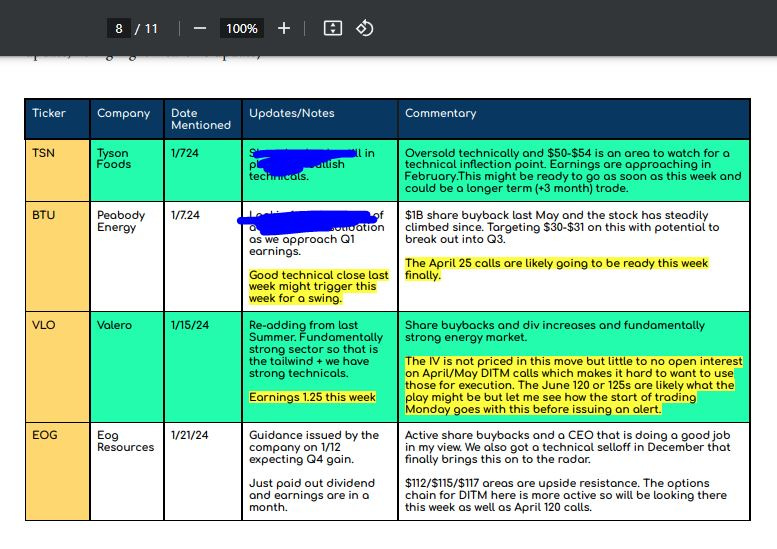

If you’d had told me 8 years ago that I would be looking at Japanese equities or paying attention to Tyson Foods because Chicken prices were rising again I’d probably have brushed you off. Today, that’s a reality for me because the markets and financial landscape have shifted and it’s one thing to recognize that shift and it’s another to act on it.

And the way things are shifting presents an opportunity where most others cannot go due to their ESG or corporate handcuffs and that presents an opportunity in itself. And even for the individual investor who is out there chasing the “AI” fads narrative or the ‘rate cut’ narrative so they can stay long, that still is not enough. Personally, I’ll be diving back into (and have already) inflation-linked equities, energy markets, and a lot of tactical short-selling which is about to, in my view, make a great comeback into the middle and latter part of 2024.

Those who are not prepared will be a part of the wealth destruction part of the cycle and those who are will be met with wealth transfer and rightfully so given the fuckery we’ve all had to endure from Globalists and the rest who run the system.

Be open to a perspective shift because the era of buy and hold, or that rate cuts will save you is a first-order thinking thought process. It will take more, even if that means learning to understand macro a bit and applying that. So embrace that and prepare because this is another wealth transfer in the works just not in the way most think.

So while I may have missed a big part of that wealth transfer in 2020 I certainly don’t plan to miss it this year and during these coming years because it is coming, it’s started and there’s more to come as we head into Summer 2024.

See you there with me!

Dan

📘 Want more of this? Read Trades v. Investments

🕝 Want me to do the research and structure swing-trades? Get a Free 21 Day Trial

🖥️ Investment professional or independent trader? Join DeltaOne

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.