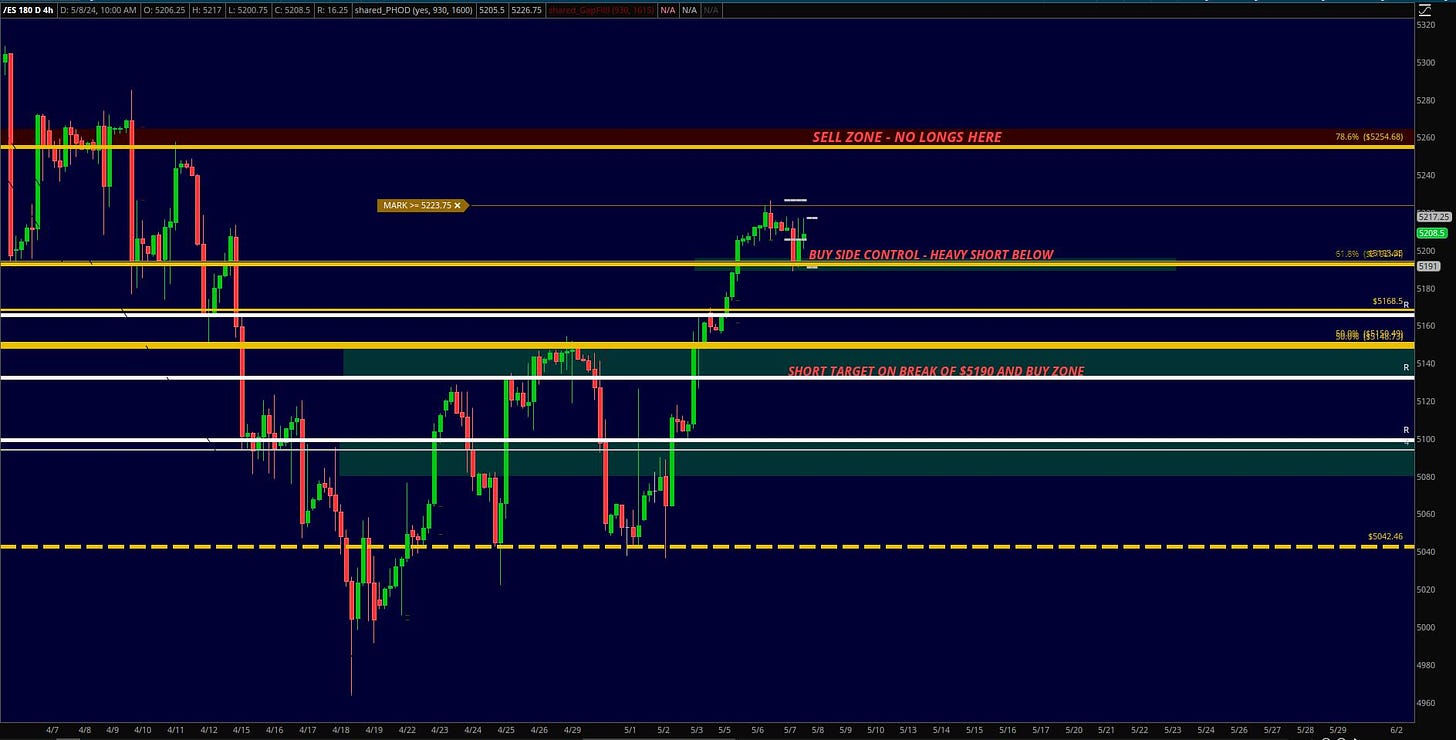

The gap down today traded right into support as discussed in the recap, we absorbed selling and the rally continues. Everyone can breathe a sigh of relief, or is there a sell off coming into Friday? I cover this tonight in the video recap below which is free tonight to view.

These were some of the notes in the recap last night regarding the $SPX

$5220-$5225 is resistance for this S&P tomorrow. Above that $5245-$5255 is on deck. Below that $5225 then we need a break of PLOD / $5205 to take us to $5190-$5185. If that does stick then just a grind back higher. If we fail $5160-$5170.

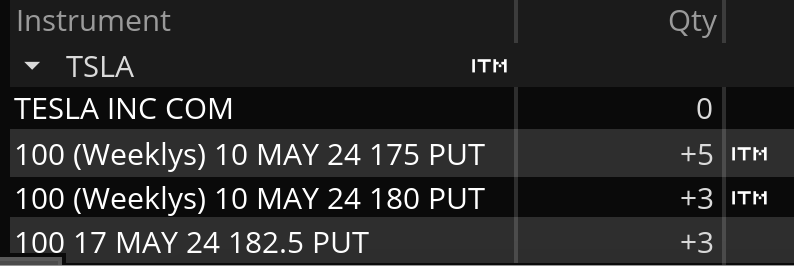

I took overnight risk home in a few names but Tesla and MSFT were the ones that panned out the best. I covered some of the Tesla but still hold some short as discussed in the video below.

About a $6K day on TSLA 0.00%↑ and MSFT 0.00%↑ short overnight.

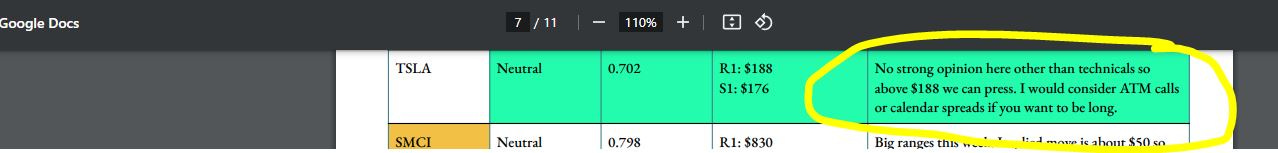

This was discussed Sunday on Tesla having to get above +$188 which we did not so opposite field trade. We need to hold $170 now and regain $180.

If we do that we can try to get a positive bullish weekly candle and rally.

Microsoft is at a key spot. $412s is a big area to get through and if we do, $430 is a target, if not, a nasty reversal is in the works.

The point is - this market— $SPX/$TSLA/$MSFT/$QQQ are all at CRITICAL INFLECTIONS.

Carvana - was flat today. No news just yet but $116 might print and I don’t plan to update on this anymore until new material news comes out. The short is a duration based position for me so just sitting back.

Bank of England has their interest rate decision meeting tomorrow at 7am so that should have a ripple effect into the US equity open. For S&P500 that $5190 area is still key and we still need to reclaim $5225 or else we have an issue.

This post is free tonight. Enjoy.

Trading Notes:

The BOE meeting is a big deal - if we break $5190 then $5160 is a target and that likely takes us down to $5140-$5150. If we end up doing that then pressure likely stays lower all day and I would not look to be dip buying. $5130 is key as a last resort and if you lose that it’s back to our beloved $5090 area from a few weeks ago.

Rally Scenario: The $5225 spot is key and takes us up into $5250-$5260 area which there is key for this market. We likely pause there so that really has to be watched. I would be cautious for outside day reversals on the markets if that are prints but if we stall on first touch then higher we go. If we get there I expect sellers to come in and that produces outside day reversals (ODRs) across the board so even with a rally it’s bearish sentiment on the highs.

That Nasdaq / QQQ bothers me too. $442 is a spot that has to clear or we’re going to get a nasty reversal back to $434s. In the recap last night I mentioned going home short some names overnight because of a level on that market but this $442 spot is key. If we lose this then $434 and maybe $430 is in play into Friday.

So again, this BOE meeting is REALLY important to the markets here because of that data and suspect technicals.

What we might end up seeing is an outside day reversal tomorrow if we rally which is bearish for everything and there are caution signals everywhere to be concerned about - at least from a technical perspective.

S&P500 - $5190 or lower releases a lot of selling and a big leg down. Watch the video for the full insight.

TSLA - Sunday I talked about +$188 clearing. We didn’t do that so now the move is a leg lower. We need to get back above +$178 then $180 at a minimum to even consider a long (at least for me) and I am still short some of this as of close but will cover that if we don’t get weakness off the first 60 minute opening drive.

Nightly Video Recap

📘 Want more of this? Read Trades v. Investments

🕝 Want me to do the research and structure swing-trades? Get a Free 21 Day Trial

🖥️ Investment professional or independent trader? Join DeltaOne

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.