The S&P500 started off the week lower led by NVDA and SMCI which were both off the highs and what could mark a short-term top for the market. SMCI is down nearly -9% on the day and NVDA is off almost -6% as we await earnings on the stock tomorrow after the close.

In issue 6 of TheLongVol Report I talked about why the S&P500 highs were dangerous and that we were to likely to see risk off ahead of economic data. You can read the report here if you missed it. In last night’s report I talked about $4970 being a key spot for the market and that if sellers were to get below that area, that it could be a sign of short-term trouble for the markets.

One of the things that you have to do when you manage a portfolio is pay attention to overall market risk - headwinds like the S&P500 becoming toppy matter especially if you carry a high-beta portfolio, I don’t, but as I said yesterday trading the index short with size is a great trade.

We were really weak on price action all day and with no news catalyst today the tape was incredibly slow. But, that doesn’t stop the retail NPC options trading crowd from diving into TSLA which was also down on the day nearly -5%. Some of this week’s options chain saw over +100K plus in volume.

This is the NPC options trading world we live in today; throw size, hope make $500 then make a “Simple to learn strategy” course - and for the record, this worked well (directional) back in 2011-2017 years but the last few it’s just a bit harder but part of sticking it out in this game is figuring out new angles. I took $50K to about $350K in 18 months in 2014/5 just trading directional but there were other rules that mattered. Today it’s an absolute free-for-all out there and there are little to no fundamentals being taught, in my view. If you’re a reader of this and are newer or trading with a small account, then the SAT Options Training is a good foundation.

Again, there are frameworks for everything in the markets you just need to define what it is you want to do, what your capital stack will allow for and then pick a route.

If you’re unsure, I am happy to chat just drop a line.

This morning, I talked about the range that the S&P500 likely traded in until the Fed Minutes tomorrow and important economic data Thursday and without news that usually creates a lower volatility environment; experienced traders can recognize that ahead of time and choose to not participate or to trade smaller given the lack of momentum.

There was a swing long on in the AST $100K portfolio and I stopped out of it. The stock is too correlated with the S&P500 and given the NVDA report tomorrow, price charts on S&P and economic data Thursday it’s just bad portfolio management to keep that in.

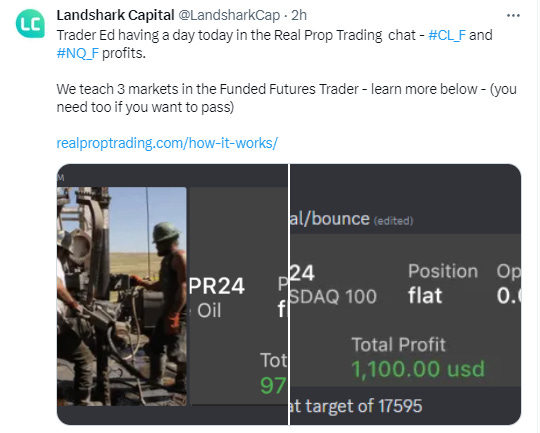

I shorted Crude oil today for some small trades while we await this week’s data and made a little money along with some in the sister company chat, RealPropTrading. That was good for nearly $1K so I’ll take it on a low momentum day which is testament again of why being able to trade cross-asset class helps, at least for me.

Overall, still bullish there short-term but remember, how you execute on analysis is dependent on each trader’s playbook. You can take a bullish idea on WTI Crude and extract a lot of ways to trade on it: intraday, swing USO calls or just buy and hold.

Valero, ticker VLO, came off the highs well from last week. I knew that we were at a spot to watch now it becomes a game of do we test prior support areas. As I am finishing creating the FPT (Foundations of Professional Trading) I got to the section today where I was recording the Top-Down Price/Technical Analysis portion and remember making a comment; in the hedge fund business many shun technical, and I would too given the terrible application of it. However, it works when you combine it with top-down fundamentals and when you’re actually trained on it. I don’t believe in moving averages, indicators or anything else - but levels and time frames do matter and with Valero it has to hold $130 . If it does not, regardless of the strong fundamentals it just cannot stay in my book.

If you are reading this then this is where you have to decide how you manage an account. Is it active, long-term or a mix of both. That’s a big question to ask especially for those who believe everything is buy and hold - if you don’t ring the register or if you think there will never be another trade again and get tied to the green on your screen, you’ll be forever disappointed.

Other than that, we need to hold $4970-$4960s and the NVDA earnings post market tomorrow combined with Fed Minutes at 3pm are catalysts for the entire market so I expect this range to stay in place until those are done. For you futures traders reading this, remember that as you stare at your book maps/volume profile tools and indicators; I know your gurus may have told you that’s all you need but no market is an island and a stock like NVDA, given the current rise, matters when it comes to earnings and the entire market is watching that.

I am going to dive into a few things in the premium video tonight that relate to the difference between technically driven trade ideas v. Top-Down driven trade ideas and why there is a difference you should pay attention too.

If you’re someone who has only used technical or shuns them then you should listen to the video for tonight.

In The Premium Section Tonight:

S&P/Nasdaq/Crude outlook for tomorrow

A few thoughts on MSFT 0.00%↑ levels

NFLX 0.00%↑ lesson - why just using technical fails if you don’t have context

Update on VLO 0.00%↑ and technical support

Why reading the market contextually matters before you start the trading day

Keep reading with a 7-day free trial

Subscribe to The LongVol Report to keep reading this post and get 7 days of free access to the full post archives.