Quick Read/Links

Here is a recap of what you missed this week in the markets. These are highlights from the week for data/news that I am watching as well as highlights from the weekly report.

Thursday was a good day for momentum longs from the report. A lot of large dollar intraday trades.

Uncle Joey & His Cronies are raising royalties and fees on Federal Land for Oil companies.

Gold made new highs but is at a zone of caution (technicals from LongVol)

Credit card delinquency is at the worst on record (LongVol Twitter)

I got a 30-mile ride in this morning, hence the post coming out later than usual. It was just too nice out in Phoenix to stop so I ended up checking out a new path the city built near Sky Harbor. (took a video here)

It’s amazing how busy this place has become with everyone that has moved here. Housing prices (For what you get) are now at levels or proper ridiculousness but like all things, I think that is in for a rude awakening soon across this sector at large.

For those that dug into CPI this week there were some clues there (so I thought) that make me want to avoid home-builders - again, not that I am or was a long-term investor in them but for those following….

I’ve been tracking that sector for a short. We made a lot of money last August shorting them and Q2 was when I said I thought they could be in for trouble again and he were are.

The Market At Large

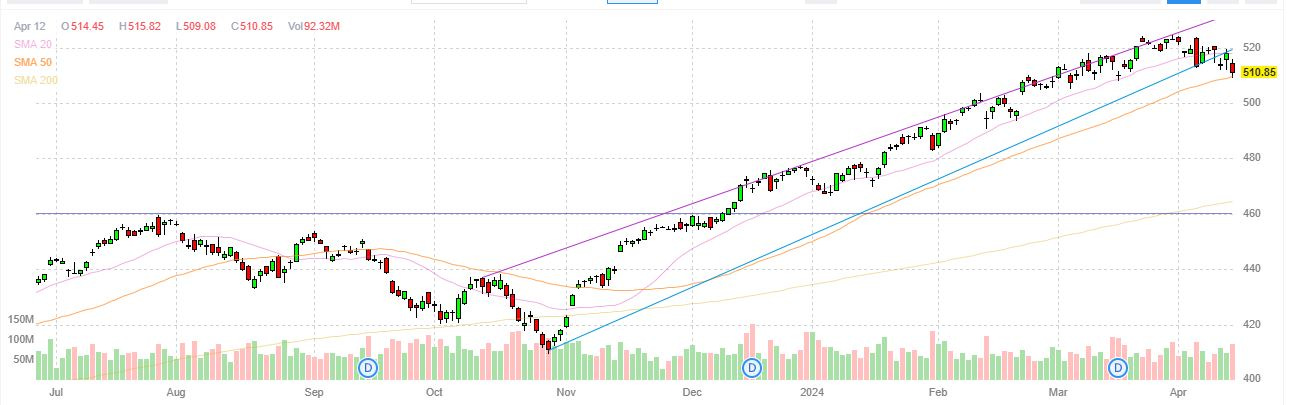

CPI came in hot but the market shook it off then Friday we had fear hit the markets one in part (allegedly) due to tax-loss selling and two in part to The Middle East.

Reality? We’re just technically extended in my view and to be really blunt: you need a pullback. If you’re reading this and you’re one of the hard-heads that refuses to trade in and out of markets because “you have a 20-year plan” then probably not the blog for you (Dave Ramsey or Edward Jones prob best) - so whatever reason you want to allocate to it by all means.

I’m going with what I know to be true: Price.

Buying things in euphoric phases (whatever it is) never ends well but the great thing about markets/life is that everyone sees things differently and those differences make all the difference (say that 3 times fast).

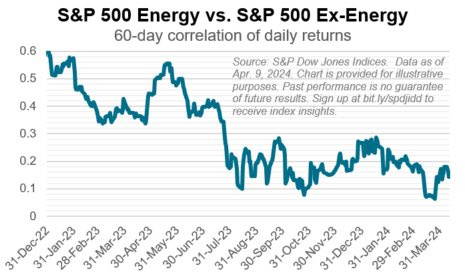

Month-To-Date most large-cap sectors are down but energy remains up.

A few names there need technical pullbacks and new legs higher can start and the way I see things is that most should be looking in this sector for new longs v. chasing overvalued & extended names in the S&P500.

I promise….if you just step away slowly from the narrative you won’t be harmed.

You’ve also got new fuel added to this fire (as if you needed any more) for wanting to be long-selected oil & gas names with a new piece of data.

There are many takes on this and that take and how you process it into an actionable idea is all that matters. But, this makes it harder for some oil/gas companies to expand and develop and that's been the case the last 4 years.

This, in my view, only adds to more share buybacks and dividend increases but we’re close to election season and if Trump wins and energy policies change we might have to re-asses this sector - but, we’re at least 6-12 months out from that just something to consider as we get into the later innings of energy sector longs.

To wrap this up - I think it’s better to explore other long trades outside of S&P500 and Russell names right now at least for those of you that read this blog and want to be active with your allocations.

Moving on….

A Lesson for the Day Traders

Day trading gets a bad rap and rightfully so - most are genuinely clueless as to what they are doing and by societal norms “investing long term” is more accepted anyway.

What I want to do this week is give you a lesson on the execution of a trade because that matters more than most think, even for those of you who are “passive investors” (until you’re not)

The reality is that trading intraday makes a lot of money for those who are initiated. Whatever it is you are trading there are always 3 things, as I see it, to executing profitably:

Catalyst

Trade Structure

Execution (how you deal/actually get in/out manage the trade(s)

Doesn’t matter if it’s futures, a small-cap micro stock or high beta equity options like the professional Instagram and YouTube traders do, you need all three.

The execution part is particularly hard if you are not initiated to it.

The market has its gimmicks/theatrics to help: the counting candles strategy, Renko charts, moving averages, and head and shoulders shampoo patter…it doesn’t end.

I’m not saying the way I do it is the right way but I’ve been pretty dam good at it for over a decade and it’s made people around me a lot of money using these approaches so….it just might be. You be the judge.

On Friday NVDA had a really good move. The order flow/price-action (whatever you want to call it) was as good as it gets so let me illustrate in this lesson:

In the first 30-60 minutes of trading, there is always liquidity in one direction meaning the order flow is strong - this is especially true for high-beta equities, index etfs - really anything with larger volume. The stock had a level at $888, it probed that found some support, failed, probed again, found some support before testing again.

Now what you are not seeing on that is that the high time frame (4H/60H) was bearish.

What you are also not seeing is that market sentiment (Middle east/selling) was bearish.

Those matter contextually when you execute on any investment. Buyers tried to absorb that are once at the open, twice near that 7:30 am part and then the third time failed to hold it.

Finally, they gave up. And that is when you press the short meaning you a) get in or b) if in you add to the size and hammer the bids.

Read that again if this is new and digest it because this is a big lesson that I am giving away for free to those who are reading.

You then had support at *$875 and the price absorbed there. The trade was done.

Why? Because it was 3 pm on a Friday and you are playing probability, not possibilities which most amateur uninitiated traders tend to do: possibilities.

That’s called trading “level to level” - you’re trading/you’re dealing but in a 15-2 hour time horizon and all the while in control because you, if initiated, come into each day with a plan and understanding of what you are after.

Price action doesn’t just drop or rally to areas/levels/price points that are not known.

They move toward certain spots where other market participants who are also initiated know where to begin looking. Whether that is algorithms dealing near levels/areas or actual persons the deal/trade takes place at spots where you, ahead of time, know where to start looking.

Those who discard this idea are simply on the outside without the insights of how this all works and to you I say….get into the FOPT training.

That or head over to The Dave Ramsey Podcast and let them pitch you on the idea that “Over the long haul the S&P500 always wins out so just don’t worry about timing the market, just keep adding into your account and when you’re ready to retire you’re gonna be a winner”

All joking aside - that’s not a bad model for those who are already wealthy but for those of you wanting to expedite that process or just learn then start gaining new perspectives because there are many aside from what you see.

Weekly Q&A

Q: How much (if you were telling a family member) would you need to comfortable swing-trade DITM options like you talk about - Ed from Chicago

Q: Can you touch base about the Carvana short, what are we looking for. Is it just the technicals we are waiting to play out? - Ron, Wisconsin

I’ll get the YouTube video answering these questions and expanding on this post later today.

Until then enjoy your Saturday.

Dan

📘 Want more of this? Read Trades v. Investments

🕝 Want me to do the research and structure swing-trades? Get a Free 21 Day Trial

🖥️ Learn to generate long/short investment ideas on your own - The FOPT Training

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.