Here is a recap of what you missed this week (WYMTW).

The video is below, you can subscribe to that, and I am opening up Q&A again for a weekly Q&A on these posts. Email in to submit - Q&A is at the end of this week.

Google closes above a $2 Trillion Market Cap for the First Time

HSBC note on Global Fung Managers shifting exposure to Chinese stocks

I’ll be getting the LongVol Report out later today instead of Sunday. Last week there was an issue with TOS so had to delay it all week. It’s wake-surf season in Arizona so Sundays are for surfing and I try to make the most out of that and we started last Sunday.

Last Summer we did a Lake Powell trip.

That’s the plan this Summer as well because surfing there with that water is just incredible and early morning it was pretty much glass which makes the wake better.

I uploaded a video here but that doesn’t do it justice.

Moving on to some market related stuff…

The Market at Large

Last week being earnings most of the S&P was just pumps/drops due to the large caps moving things around. Great for those that run intraday/vol strategies and it was a good week in DeltaOne.

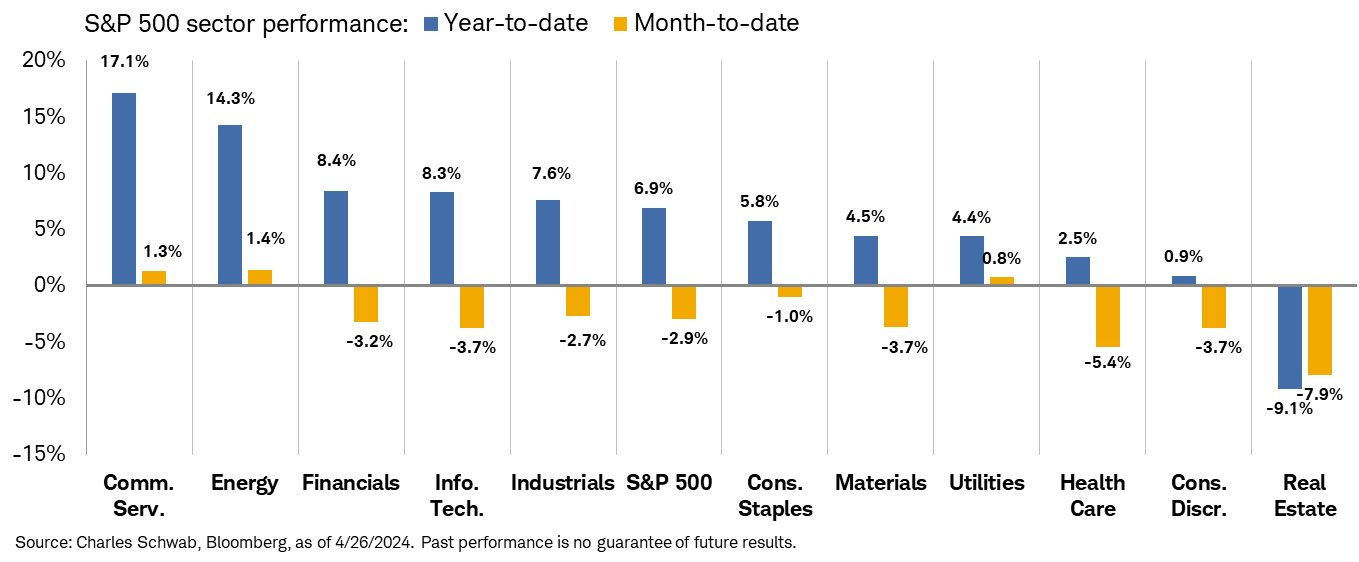

Real estate still lags and energy is still doing it’s thing

Still waiting to dive back into some oil & gas names

I posted something similar a few weeks ago but Nick at reVenture posted this. I had a chance to get on a call with him about 8 months ago and have followed his work since.

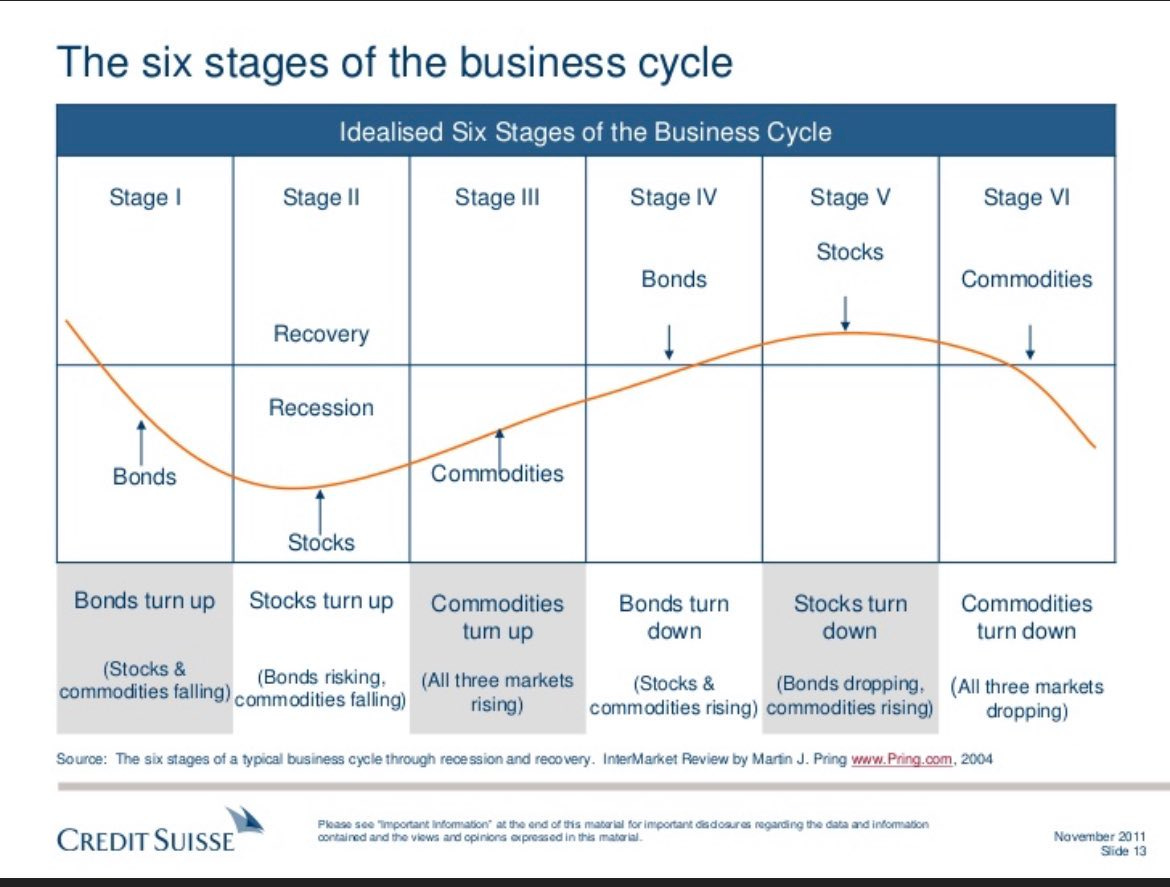

This was an interesting post I came across. Following the business cycle is an important part of the investing part of my business, esp. in sector/stock selection, and this was a good graphic I wanted to share.

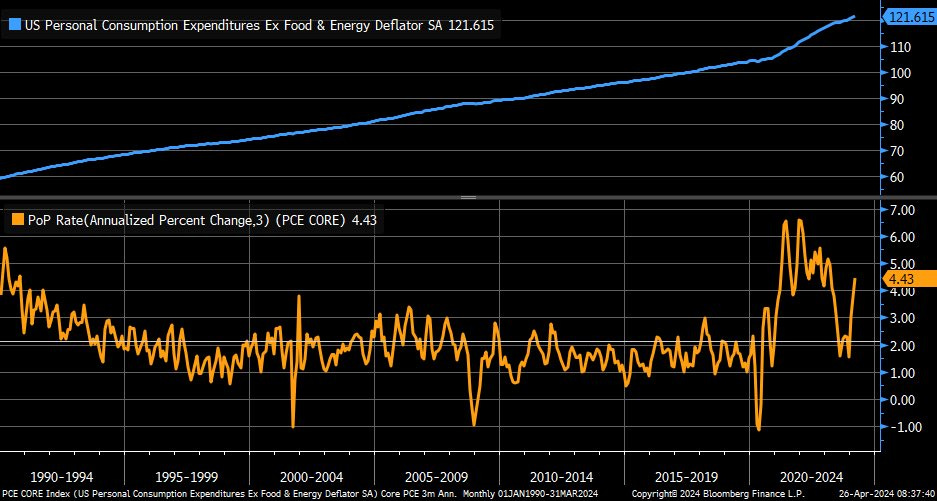

The inflation trade is on and putting together the right basket of names to invest/trade that is key. I discussed a few here with US World Report and News.

PCE Inflation up to +4.4% in March.

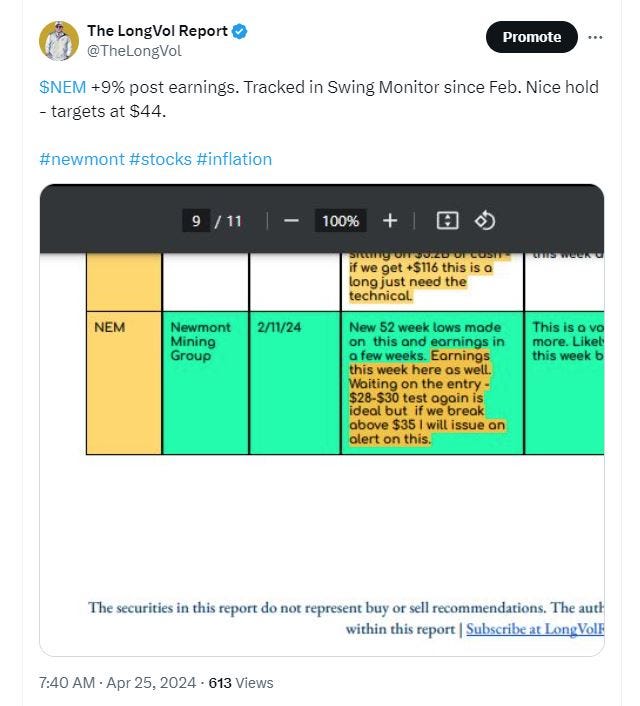

One of the trades in The Swing Monitor ( NEM 0.00%↑ ) had earnings this week and was a big win. (Twitter link)

These were notes for subscribers in Issue 13 of the Report

In Q1 it was clearly AI and in Q2 I think there’s a rotation slightly out of that (not fully) just risk off and that risk going into metals etc. - it already has if you look at some names related to that theme ( LPX 0.00%↑ and FCX 0.00%↑ as examples.

As a note, I don’t like trading GLD 0.00%↑ too too much (but I have) and I would encourage those looking into this to find other correlated names that might perform better - that’s how you create quality long/short ideas to ring the register; creativity and a little research - I added one already in the Special Sits monitor.

Reader Q&A

Q: None this week / No video.

📘 Want more of this? Read Trades v. Investments

🕝 Want me to do the research and structure swing-trades? Get a Free 21 Day Trial

🖥️ Investment professional or independent trader? Join DeltaOne

This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investments. Any such solicitation of an offer to purchase interest will be made by a definitive private placement memorandum or other offering documents.